Capital Raising

OPEN

StanAurum Limited

A Strategic Metals Emerging Miner Right place, Right time

INDUSTRY

Resources & Mining

RAISING

A$800,000

PRE-MONEY VALUATION

A$2.8M

MINIMUM INVESTMENT

A$25,000

Investment Highlights

Company Overview

Transaction Overview

Products & Services

Team

Transaction Summary

StanAurum Limited

Raising: A$800,000

Pre-Money Valuation: A$2.8M

Minimum Investment US$25,000

Investment Highlights

StanAurum ready for imminent boom in Strategic Metals tin tungsten Bismuth Molybdenum.

Strategic Metals in major constrained supply, tin “the glue” soldering all electronic circuits.

140 million tonne exploration target Strategic metals, 80,000 tonnes tin past production.

Experienced management corporately running listed mining exploration companies.

Funds from the current capital raise will be allocated toward preparations for the Company’s proposed IPO and listing.

Tin and tungsten exploration & development company with assets in QLD and northern NSW. Covering 80,000 hectares of fully compliant tenements.

Board and management team with 100+ years of exploration and ASX-listed company leadership experience.

Preparing for IPO on the ASX to provide shareholder liquidity and growth.

Strategy focused on developing a globally significant tin–tungsten resource.

Transaction Overview

Terms of offer:

8,000,000 fully paid ordinary shares @ $0.10 (10 cents) minimum parcel $25,000

USE OF FUNDS

IPO Costs & Process plus Definition Drilling of Resource.

Independent Geological, Auditors, Legals, Due Diligence | Lead Managers, Sharebrokers, Markets Commission Fees | Administration, Stock Exchange Fees, Independent Accountants | Exploration Drilling, Assays, Marketing, Roadshows, Travel |

|---|---|---|---|

25.5%

Fill Counter

| 22%

Fill Counter

| 20%

Fill Counter

| 32.5%

Fill Counter

|

Company Overview

StanAurum Limited is an Australian unlisted public company focused on the exploration and development of mineral assets, particularly tin and associated critical minerals across Queensland and northern New South Wales. Established in 2021, the company is headquartered in Victoria with its exploration office located in Stanthorpe, at the heart of Australia’s historic Granite Belt tin field. Guided by the principle of using innovation to discover and competence to produce, StanAurum is committed to operating with fairness, transparency and ethical standards while delivering value for shareholders and the communities in which it operates.

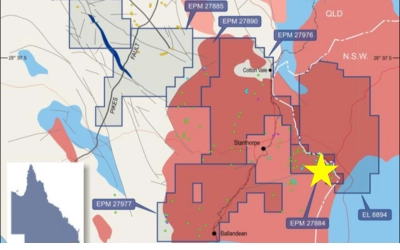

The company’s exploration portfolio spans approximately 80,000 hectares of granted tenements across tin-bearing granites in the Granite Belt. StanAurum’s focus extends beyond tin to include tungsten, molybdenum, bismuth, rubidium, kaolin clay, feldspar and other industrial and critical minerals. This diverse commodity base positions the company to benefit from the increasing global demand for metals vital to the energy transition, electronics, and advanced manufacturing sectors.

StanAurum’s strategic approach combines near-term alluvial tin opportunities with longer-term hard-rock development projects. Early cashflow from smaller-scale alluvial operations is intended to support exploration and appraisal of larger, high-potential deposits such as the Lode Creek prospect, where both hard-rock and alluvial tin mineralisation have been identified. The company also sees upside in by-products that can be developed alongside tin, such as tungsten, molybdenum, and rubidium, enhancing project economics and diversifying potential revenue streams.

The company is led by a seasoned management team with deep experience across exploration, mining development and capital markets. Director Tony Fawdon brings over five decades of experience in mineral discovery and corporate leadership, including involvement in significant Australian gold discoveries. Fellow directors Graham Rolfe, Rob Harrison and Matthew Adams add complementary expertise in geological exploration, investment markets and mining operations, underpinning StanAurum’s strategic and operational capabilities.

As global supply of tin tightens amid growing demand for use in electronics, renewable energy and electric vehicles, StanAurum is well placed to capitalise on Australia’s reputation as a stable, resource-rich jurisdiction. Its expansive tenement holdings in a proven mining district, combined with a disciplined exploration program and an experienced leadership team, provide a solid foundation for growth. While early-stage exploration carries inherent risks, the company’s diversified asset base and commitment to responsible development offer investors exposure to one of the most compelling segments of the critical minerals market.

Principal Projects

Tin Tungsten Projects

Lode Creek - Large area of tin tungsten greisen altered granite 1200 x 1000 metre footprint, a 2.58 mt target, with large overlying eluvial/ alluvial tin wash also 200,000tn of tin tungsten hosted dumps.

Sugarloaf - Large area greisenous granite hosting tin tungsten 1400 x 1000 metres, target of 140 million tonne tin tungsten.

Wards Gully - A large area 2400 metres x 800 metres of tin hosting silicified indurated gritstone, containing blind paleochannels, some identified by GP radar survey.

Lord Nolans + Holdfast

Large area 2,500 metres of greisenised granite hosting tin tungsten molybdenum with rock chip up to 2.5% tin.

Horrigan’s Gully - Reported high grade alluvial tin by Geological survey.

Spring Creek - Unmined alluvial flats adjacent to historic dredged ground, tin gold and minor diamonds.

Mt Sugarloaf and Trollope's Hill

An exploration target of 140 million tonnes at a monetary value A$188.00 per tonne has been identified at Mt Sugarloaf, Sugarloaf Ridge and Trollope’s Hill. The zone is 1400 metres x 1000 metres and estimated to a depth 50 metres.

Cassiterite (tin) & wolframite (tungsten) are readily visible in rock chip taken from the base of the hill.

Lode Creek

Hardrock exploration target 2.58 million tonnes with a monetary value of A$98.0 per tonne- Tin Tungsten Bismuth molybdenum.

Good potential to increase resource mineralised zone 1200 metres x 1000 metres. Tin tungsten alluvials 1.92 million LCM with monetary value per loose cubic metre of AUD$ 41.50 shown in yellow shading top right photo.

Previous Funding

Various over the last 5 years, Bulk of raisings:

- 2021 $1M @ $0.02

- 2022 $1M @ $0.04

- 2024-25 $500K @ $0.08 to $0.12

Notable Investors:

Team

Announcements

To view the latest Reports to Shareholders and Shareholder Updates Click Here

.General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below