Why Passive Investing May No Longer Be the Dominant Strategy in an

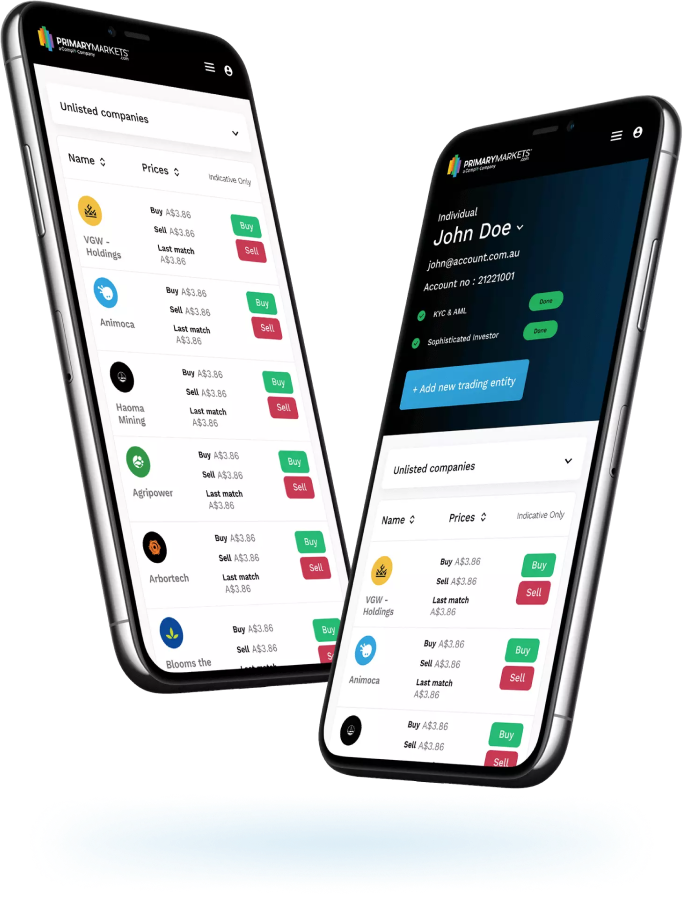

The number 1 Trading Platform for unlisted companies

100+ unlisted companies over

30+ sectors for you to trade

2 main ways to invest with PrimaryMarkets

Live Trading

Investors can access Live and exclusive private companies that are actively traded before they go public

Pre-IPO Opportunities

Over 30 Industries

Access Privately held Unicorns before they go Public

The new way to trade in unlisted shares

Trade pre-IPO opportunities with confidence on a fully secure, end-to-end trading platform.

Secure

Flexible

Compliant

Access Pre-IPO opportunities

Register in 30 seconds

Free to register

Already a member?

Login to view opportunities

Become a member

Register to view opportunities

Representing a Company or Fund?

Trusted by our global investor network to trade unique private company opportunities before they IPO.