Capital Raising

OPEN

Clean Hydrogen Technologies Corp, USA

High Performance Ingredients for the Global Battery Market

INDUSTRY

Energy & Renewables

RAISING

US$1M

PRE-MONEY VALUATION

US$50.7M

MINIMUM INVESTMENT

US$50,000

Investment Highlights

Company Overview

Transaction Overview

Products & Services

Team

Transaction Summary

Clean Hydrogen Technologies

Raising: US$1M

Pre-Money Valuation: US$50.7M

Minimum Investment US$50,000

Investment Highlights

21st Century Innovation for;

- CNTs (Carbon Nano-Tubes) Compound, Critical Conductive Ingredient for the booming battery sector

- Hydrogen

- Both products are produced using a process with no CO2 emissions

All work has been completed on engineering and we are now looking to build production plants producing income in India / Maharashtra and USA / Louisiana both Industrial states with customers close by for our in demand products

NASDAQ or NYSE list planned via SPAC in next year

Transaction Overview

Terms of offer:

Raising US$1M at a Pre-Money valuation of US$50.7M

The offer price is US$3,000 per share. For every 2 shares, you also get 1 option at US$4,500 conversion and exercise period of 5 years vesting immediately.

USE OF FUNDS

Plant & Equipment | Administration | COGS (gas feedstock, materials for running production process) |

|---|---|---|

65%

Fill Counter

| 20%

Fill Counter

| 15%

Fill Counter

|

Company Overview

What stage is Clean Hydrogen Technologies at

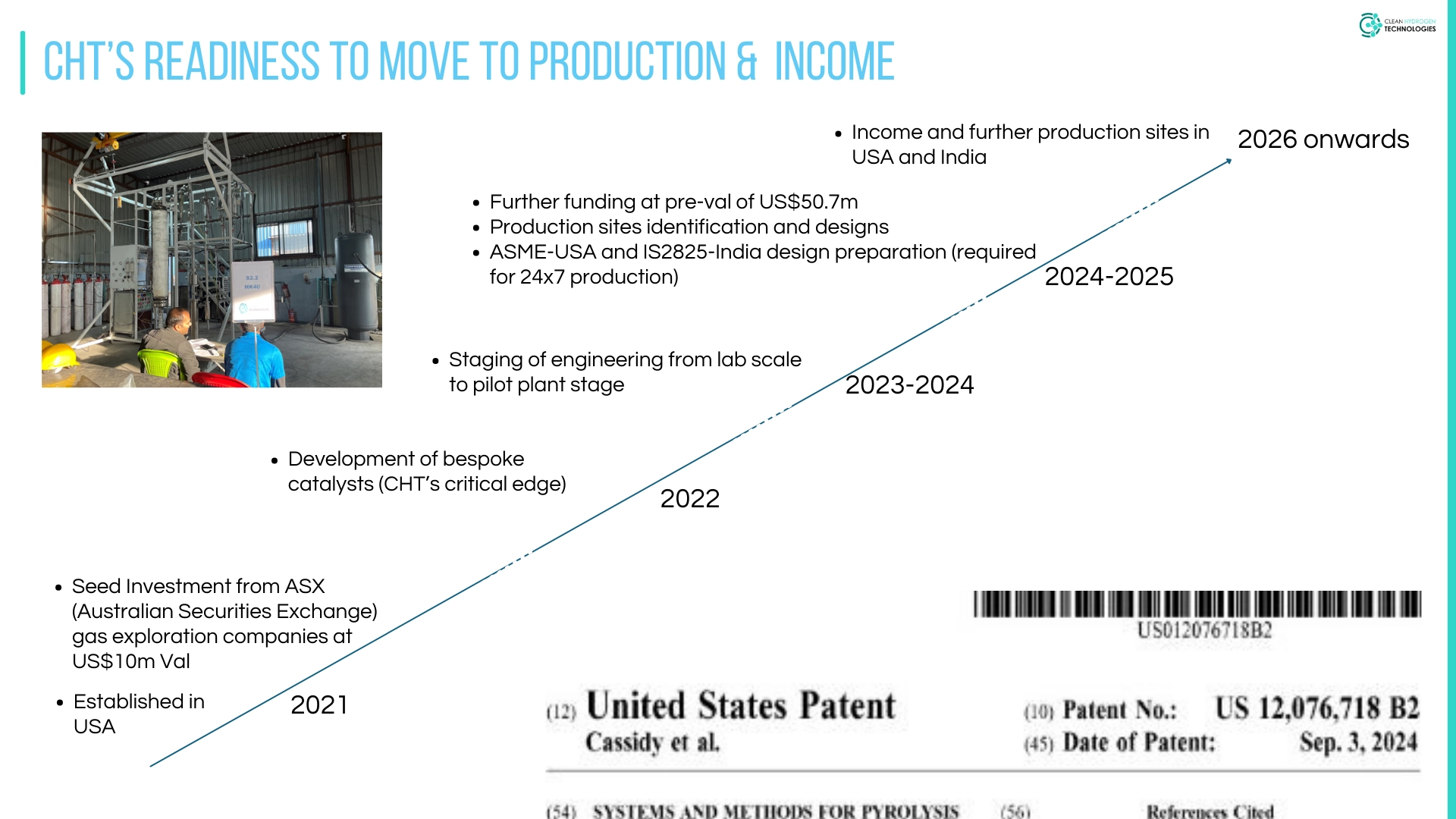

- Started development in 2021, performing all testing, staging and scaling in India, where there is a supply of talented Chemical Engineers.

- Stage 1 was focused on developing catalysts, key to the performance of their systems and quality of our products. Stage 2 focused on engineering scaling from small to production size reactors tested in a pilot plant. CHT is now ready to move to production.

- Clean Hydrogen is now ready to produce income but needs to move to an authorised production zonal area now identified, with site designs complete including critical engineering compliance such as IS2825 for India and ASME for USA.

What Clean Hydrogen Technologies do and for whom

- They produce 2 products from the hydrocarbon in natural gas; a CNT (Carbon Nano-Tube) based composite and hydrogen, where our process has no CO2 emissions.

- CNT Composites have many applications such as batteries, electronics, engineering, medical applications, air and water filtration and more.

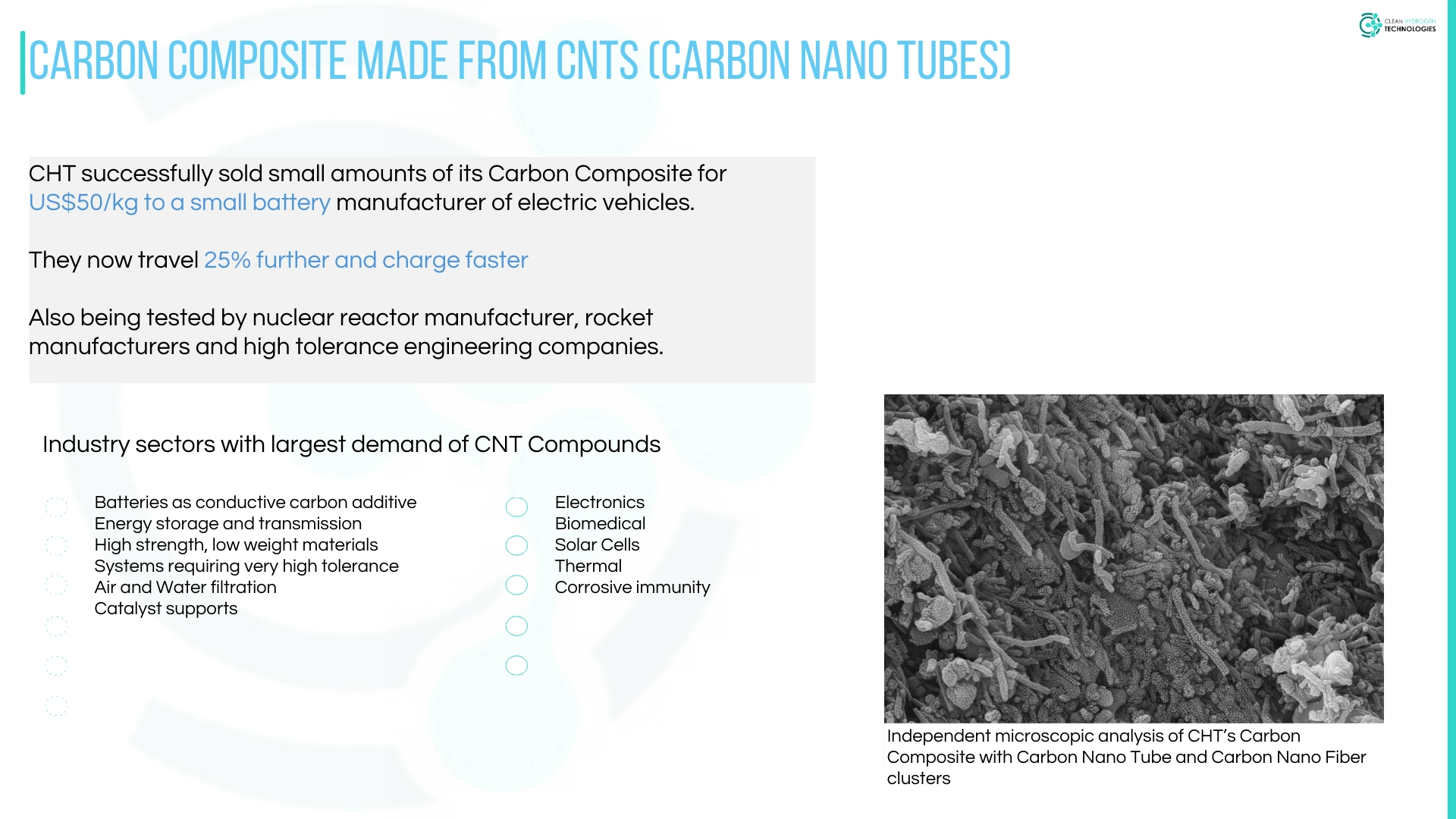

- Have sold our CNT Composite to a battery manufacturer for US$50/kg where with 1% application to the anode in a battery the vehicle travelled 25% further.

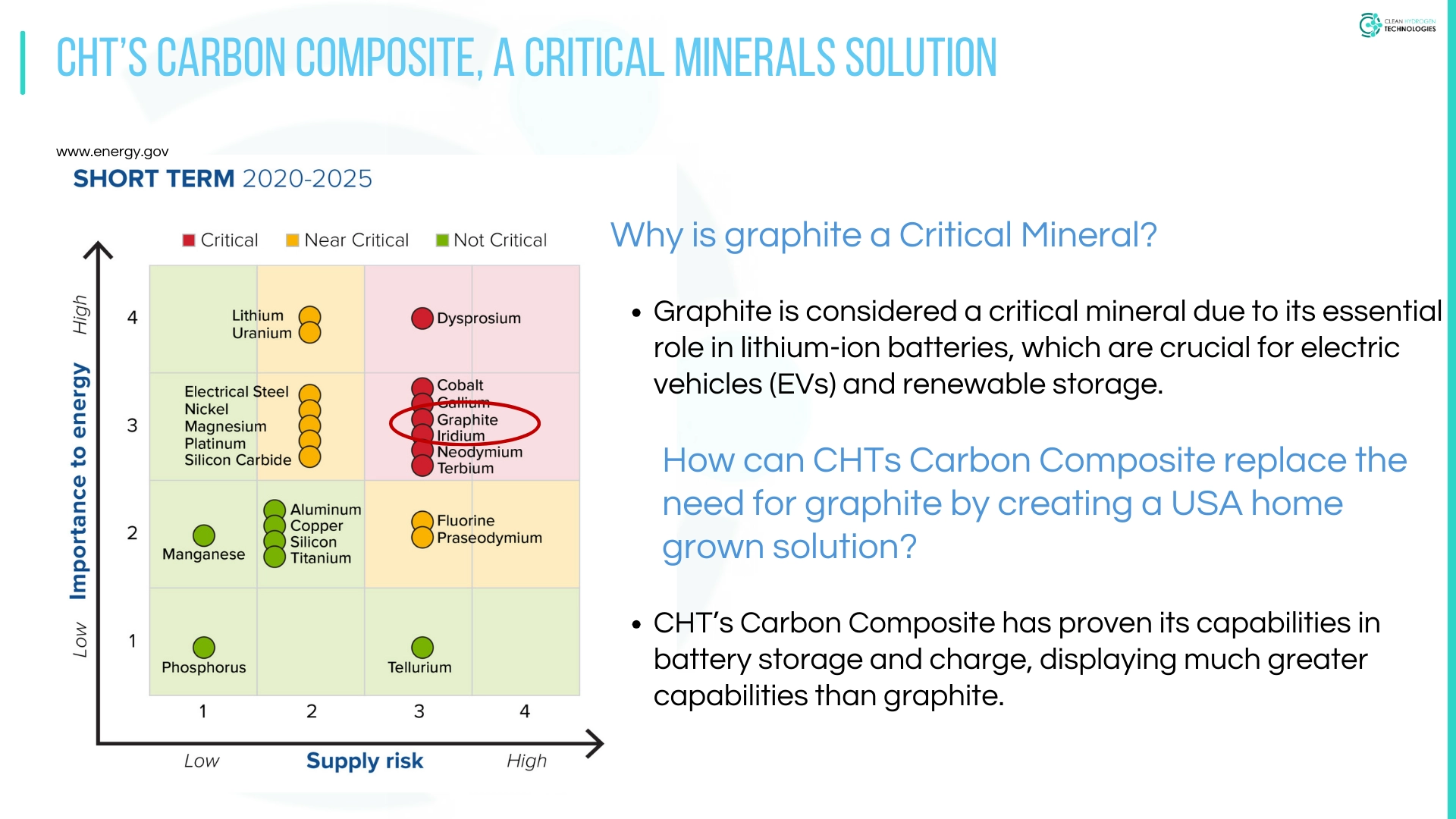

- The composite is 6 times more effective than graphite and stronger, allowing for more powerful, longer lasting batteries.

- Hydrogen will be sold initially in compressed bottled form for industrial uses including ammonia / fertilizer, saturated and unsaturated fats, glass and steel, high octane fuels and many other industrial processes.

- CHT was founded in 2021 in the USA. Soon after setup a wholly owned subsidiary was setup in India where testing, staging and scaling could be done quicker and there is a supply of talented engineers.

- The USA and India were selected as our primary markets since both are industrial with many in-demand sectors for both CHT’s products.

- Received seed funding in late 2021 from an ASX listed gas exploration company (BPH Energy) who has continued to support us to date. As such, all assertions need to be verified to ensure the investor’s statements about us meets ASX obligations for accuracy.

- In 2022 Clean Hydrogen developed their critical catalysts which provides them with a global leading edge (to the best of our knowledge) in the efficiency of the process and the quality of the products.

- From 2023 to early 2025 we staged the engineering, scaling to a production stage change to capabilities for all aspects of our processes.

- For the past year, Clean Hydrogen has been finalising the production design for their production site and also ensuring systems designs are production compliant (IS2825-India, ASME-USA).

- Now ready to move to the production plant, where this funding will help stage 2 reactors in production producing income.

- In parallel, have been approached by a party who specialises in taking companies at our stage to NYSE and NASDAQ listed SPACs for a SPAC acquisition, planned for next year.

- Importantly, once we start producing income at the production site, valuation will increase dramatically.

- Clean Hydrogen Technologies successfully had their first patent registered in the USA in 2024, and are now registering internationally with more in the pipeline.

Products & Services

Clean Hydrogen Technologies does not sell their engineering or their catalyst. They are an owner operator model and only sell products; hydrogen and CNT Composite.

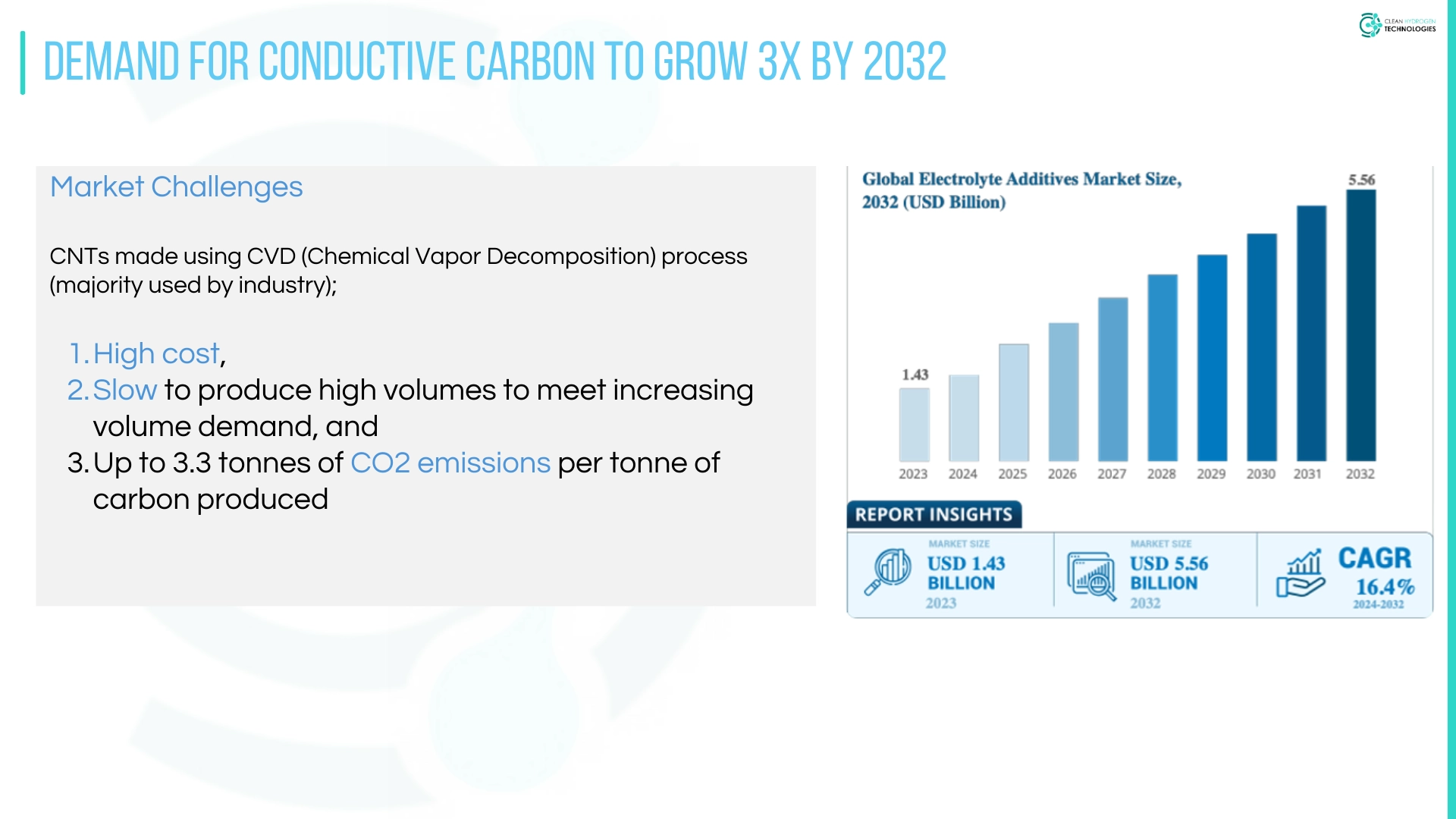

Demand for conductive carbon is forecast to grow 3x by 2032 (all due to the battery market) and clean hydrogen 5x by 2050.

CHT’s Carbon competition is graphite and other conductive additives for batteries. Graphite alone will be consumed at more than 4m tonnes globally by 2030 with the 2030 forecast seeing Clean Hydrogen at less than 2% of this total with a product that is far superior to graphite and graphene in batteries.

Graphite is considered a critical mineral in the USA whereas CNT Composite can replace its need in batteries and magnets.

General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below