Capital Raising

CLOSED

African Lion Gold plc

High-grade gold opportunity in mineral rich region

INDUSTRY

Resources

This offer closed August 2023. If you would like to discuss anything in relation to this company please contact us for further information.

All information on this page was current as at the date of closure.

Investment Highlights

Mining Contractor Engaged

Mining Concession granted for 25 years with 25 year option

Gold Mineralisation from Surface

Committed to Sustainable ESG

Company Overview

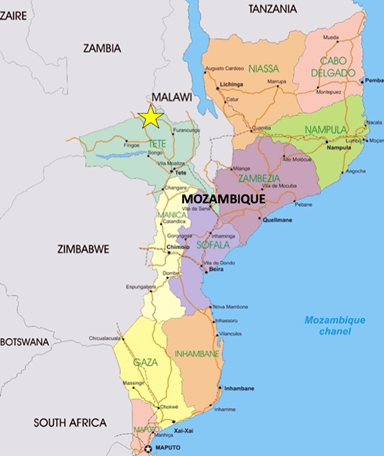

African Lion Gold plc (ALG) is an exploration and mining company focused on gold and associated precious metal discoveries in Mozambique.

Mozambique is politically stable with a multi-party democracy and has resilient GDP growth. It is one of the most under-explored countries in the world and in the past 5 years, major discoveries include the largest graphite deposit, the largest ruby deposit and the second-largest gas deposit in the world, with a recent surge in significant gold projects.

The Mozambique government is committed to foreign investment in mining with attractive project tenure and a mining-friendly operating environment. ALG has established strong relationships among local governments and communities.

Highly experienced team with a wide range of skills in project acquisitions, exploration, mining and in-country operations, as well as project development from conceptual stages to operations

Maiden Mineral Resources expected in the second half of 2022 and ALG plans to list after completion of the Maiden Mineral Resource.

Initial exploration has uncovered high-grade gold zones surrounded by a wide lower-grade halo with mineralisation from surface.

ALG defined an Exploration Target of 220,540 to 1,369,600 oz Gold on only 3 of the 20 Prospect Areas with substantial Blue-Sky potential on the additional 17 Prospect Areas.

First Feasibility Study to be completed by 2024 with the goal to produce a Multi-Million Ounce Resource.

Chifunde Project at a Glance

Access 60 km from Kamudzu International Airport, Lilongwe and 220 km from Chingozi International Airport, Tete

Size 170 km2 (17, 000 ha)

Ownership 80% ALG; 20% Mozambique Partner

Status Mining Concession granted 14 September 2021

Work Completed Geophysics; 7, 190m of Diamond and RC Drilling; Soil Sampling Program; CPR completed by SRK 2022

Exploration Target 220,540 – 1,369,600 oz Gold

Positive Drill Results High-grade intersections of 5.00 – 38.00 g/t Au and wide lower-grade halo.

Deposit Type Shears in Thermal Aureole Gold (TAG) Setting

Want to learn more?

Fill in the expression of interest form below