Trading

ARC Ento Tech Ltd

Winning the War on Waste

INDUSTRY

Technology

STATUS

Open

OPEN TO

Public

Investment Highlights

Will shortly begin construction of the Hawkesbury City Council project for the first commercial ARC processing facility for NSW. Hawkesbury City Council has given the green light to commence with the commercial agreement approved October 2024.

The plant is scheduled to be commissioned in May 2025.

ARC has secured purchase orders and deposit payments for its SYNCOAL product for a total volume of 60,000 tonnes this year, to increase to 120,000 tonnes in 2026 and ramp up to 600,000 tonnes in 2027. The first bulk shipment is scheduled for May 2025 from the operation of a number of dedicated SYNCOAL plants for converting waste plastics and residual organics into a sustainable coal and coke alternative.

ARC has also been approved by the Kenya government to commence the construction and operation of an ARC processing facility in Homa Bay County, Kenya which will be the pioneer of this technology application in all of Africa. An associate African company has been established, Ento Tech Africa Ltd for the purpose of promoting and applying our sustainable and effective resource recovery technology.

Have successfully tested and developed the application of its SYNCOAL product as a blend to make metallurgical coke using BHP coal. This project was successfully completed under a TrACE grant partnered with the University of Newcastle (UON) and Newcastle Institute of Energy and Resources (NIER).

Company Overview

Recover, re-form and re-purpose waste

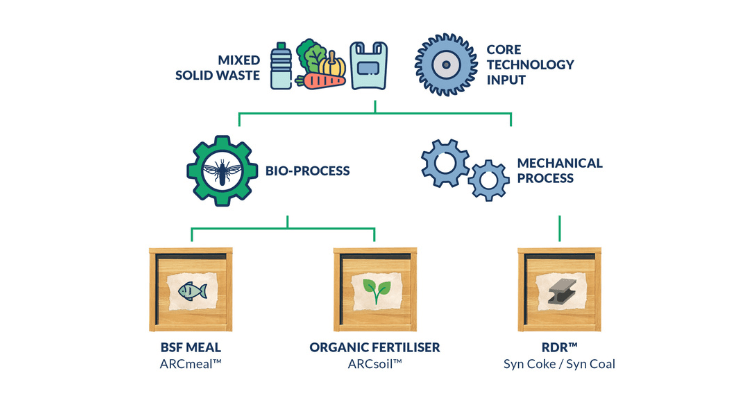

The ARC Process™ consists of processes that are used to recover, re-form and re-purpose all mixed unsegregated waste components.

From the recovery of nutrients from the organic waste components to the conversion of plastic waste into hydrogen and industrial carbon, this technology forms the foundation for real solutions to global waste challenges.

The technology utilises an innovative approach to waste recovery and upcycling and is protected under a patent pending.

Strong business model: 3 pillars of sustainability – People, Planet, Profit

Research collaborations with 3 universities to enhance value

3 pending grant applications with the NSW and Federal Governments

On a research grant for hydrogen recovery as well as commercialisation of the ARC process for recovering waste plastic

Our Story

Arc Ento Tech was incorporated in Australia in Feb 2020 after conducting proof of concept trials overseas. Its focus is on the use of insects to recover nutrients from organic waste and combining with a novel approach to recovering and converting all plastic waste into viable commercial products.

The company has established both markets and clients for the sale and supply of waste, as well as waste derived products and is ready to commercialise the first set of plants.

This is leading edge technology that will change the landscape of waste processing around the world. Following on from the demonstration and initial start-up plants there are already discussions to construct and operate at least seven full scale plants as early as 2024 with overseas expansion following shortly after.

Key Partners

R&D – Macquarie University, Western Sydney University, University of New South Wales

Processing Service Clients

Sanitarium, Sara Lee, Masterfoods, Agrana Fruit, Real Petfood, Topsoil Organics, ANL, Hawkesbury City Council, Central Coast City Council, Newcastle City Council, Bankstown City Council, Wingecaribee Shire Council, Hornsby City Council, Penrith City Council, Shoalhaven City Council

Previous Funding

Seed Capital Raise

A$1.42M

R&D Tax Refund

A$631,980

Series A Capital Raise

A$375,000 secured funds

Funding partner

A$10M 12 month schedule

Products & Services

ARCMeal™

An environmentally sustainable substitute for fishmeal used in animal feed preparation. Made from BSF larvae. Rich in protein, essential amino acids, vitamins and minerals

ARCSoil™

A by-product of the production of Black Soldier Fly larvae through the ARC Process™ is a high micronutrient ammonia rich fertiliser. It is produced from the accelerated digestion and de-composition of the organic components of MSW.

SYNCOAL™

SYNCOAL™ is a unique, innovative, environmentally sustainable, and commercially viable alternative to applications requiring high-grade coal and metallurgical coke in steel manufacturing and metals smelting. It can also be readily used in the chemical industry where a high-purity reducing agent is required.

Customers

Veta Farms, Real Petfood, Buggy Bix, Evergreen Garden Centre (formerly Scott’s Fertiliser), Seasol, Sunny Queen Eggs, MCCI, Biosupplies

Ask us a Question

Send us a message and we'll connect soon

Become a member

Become a member and elevate your experience with us!

Already have an account? Login