Capital Raising

OPEN

Ashby Mining Limited

5-Year Royalty Opportunity on two Gold Mines near Charters Towers, Queensland

INDUSTRY

Mining

RAISING

A$8M

PRE-MONEY VALUATION

A$44M

MINIMUM INVESTMENT

A$50,000

Investment Highlights

Company Overview

Transaction Overview

Team

Transaction Summary

Ashby Mining Limited

Raising A$8M

Pre-Money Valuation A$44M

Investment Highlights

Unique opportunity to capture royalties on gold produced and sold from mines in Qld. Opportunity to enjoy increased returns should the gold price rise during the term.

Funds raised applied to field and study works programs to progress to JORC 2012 Measured and Indicated Resources at Hadleigh Castle and Far Fanning Open Pit mines ahead of feasibility studies to delineate a JORC 2012 Reserve.

Current JORC 2012 Inferred Resources at Far Fanning and Hadleigh Castle of 385koz gold at a weighted average grade of 2.5g/t.

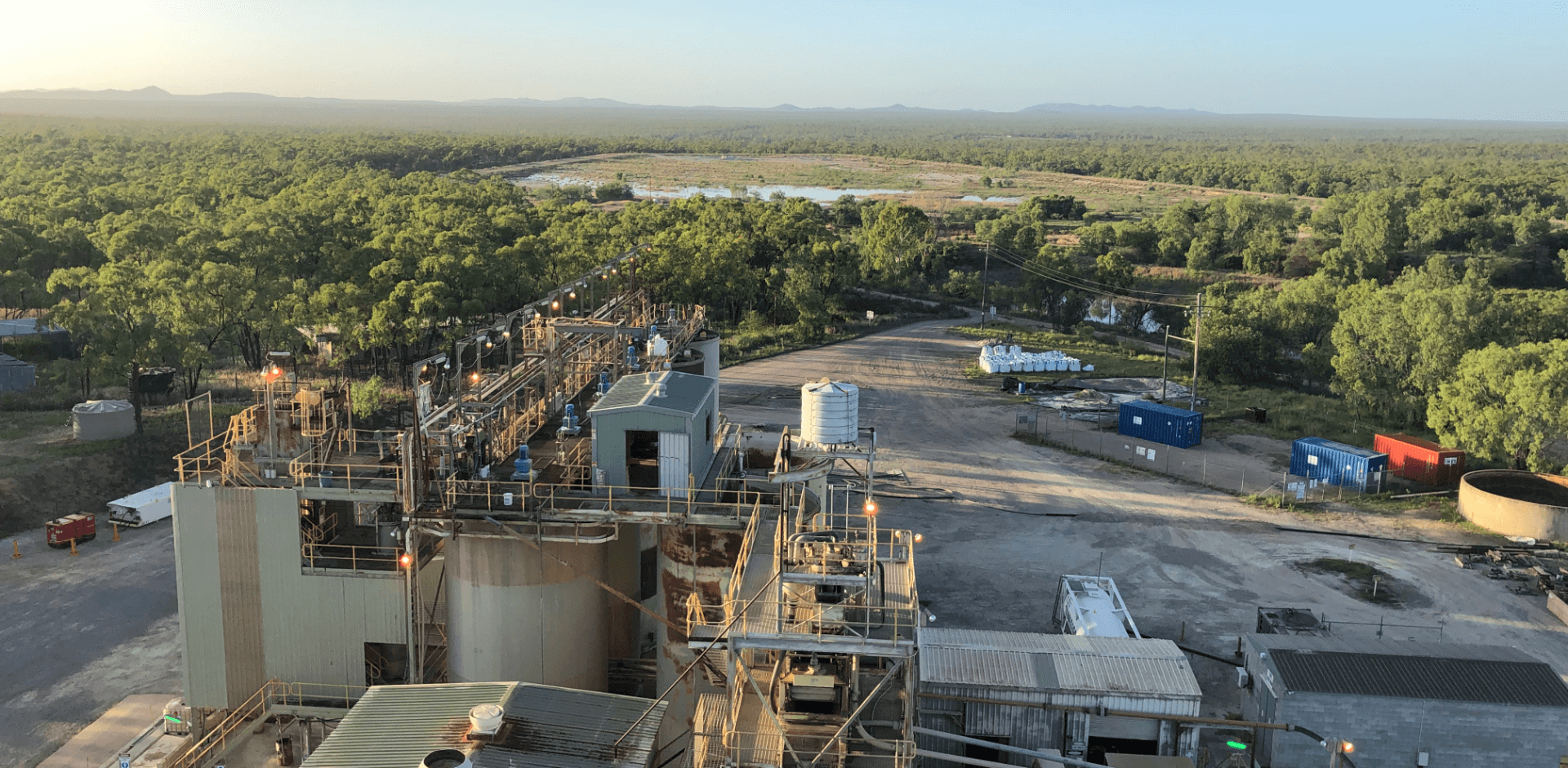

Issuer owns a 340ktpa CIL processing plant (Blackjack), therefore operations restart can occur from a small JORC 2012 Reserve from within the existing Resources.

Company Overview

Ashby Mining is an aspiring Australian mineral resources company developing a gold production business in the Charters Towers region in Northern Queensland.

Ashby Mining owns a gold processing plant and has rights to a total land package covering over 600km2 which contain historical mines, mineral resources and a highly prospective exploration potential.

Ashby Mining intends to commence gold production upon converting existing mineral resources to JORC 2012 ore reserves. Exploration and project development will be ongoing to maintain a robust project pipeline.

Vision

To be a leading mining company creating long term value for its stakeholders by transforming mineral resources into successful businesses through our passion for people, entrepreneurship and focused execution of our business plans.

Responsible Mining

Ashby believes a strong ESG proposition is not only critical to business strategy, but when executed properly creates value directly linked to cash flow.

A leadership team that is passionate about building a modern environmentally responsible and technology enabled business. By adhering to strong ESG principles the business can deliver on its priority outcomes.

Projects

A fully permitted gold processing plant located 8 km from Charters Towers.

Potential to process up to 340,000 tonnes of mill feed per year.

The project also contains historic open pit and underground gold mines and Mining Leases.

Far Fanning is a permitted Mining Lease where historic underground and open pit mining halted in 2004.

The core focus of this project is the Far Fanning gold mine and Mining Lease.

The project is located 45 km NE of Charters Towers.

Historical production at the mine was 47,200 ounces gold from 664,000 tonnes of ore at average 2.2 g/t gold.

Inferred JORC resource of 2.33Mt at 1.8g/t Au for 138,000 ounces gold.

Hadleigh Castle is a permitted Mining Lease where historic underground and open pit mining halted in 2005.

The core focus of the project comprises the historical open pit gold mine and a prospective exploration target.

The project also encompasses a significant expanse of the “Rishton Mine Corridor”, a largely under explored major regional trend that is host to numerous known gold deposits and historical mines.

Inferred JORC resource for near-surface and underground of 2.4 Mt at 3.2 g/t Au for 247,000 ounces of gold.

Transaction Overview

Terms of offer:

Cumulative Redeemable Preference Shares in Blackjack Milling. Net Smelter Royalty of 2% after Qld Govt royalty (i.e. 2% of 95% NSR) on gold produced and sold from Far Fanning mine and Hadleigh Castle mine. Royalty is paid upon each gold sale into separate bank account and then to preference shareholders half yearly. To be redeemed for cash or listed shares at the 5-day VWAP on 30 June 2029.

Each investor has the right but not the obligation to convert into shares in an IPO by the Issuer or parent company at a 20% discount to the IPO share issue price. Upon conversion, investor retains half their royalty entitlement, i.e. 1% until 30 June 2029.

5%

Administration

60%

Operations, Works programs, C & M

35%

Acquisition and Offer Costs

Enter your text here...

Want to learn more?

Fill in the expression of interest form below