INDUSTRY

Finance

RAISING

A$100M

Investment Highlights

Company Overview

Products & Services

Additional Information

Team

Transaction Summary

Australian Gulf Capital

Raising A$100M

1st Close A$25M

Fund Life 7 years

Investment Highlights

Targeted Investments

LP Co-Investment Opportunities

Global Network

Pre-Seed to Series A Investment Stage

Company Overview

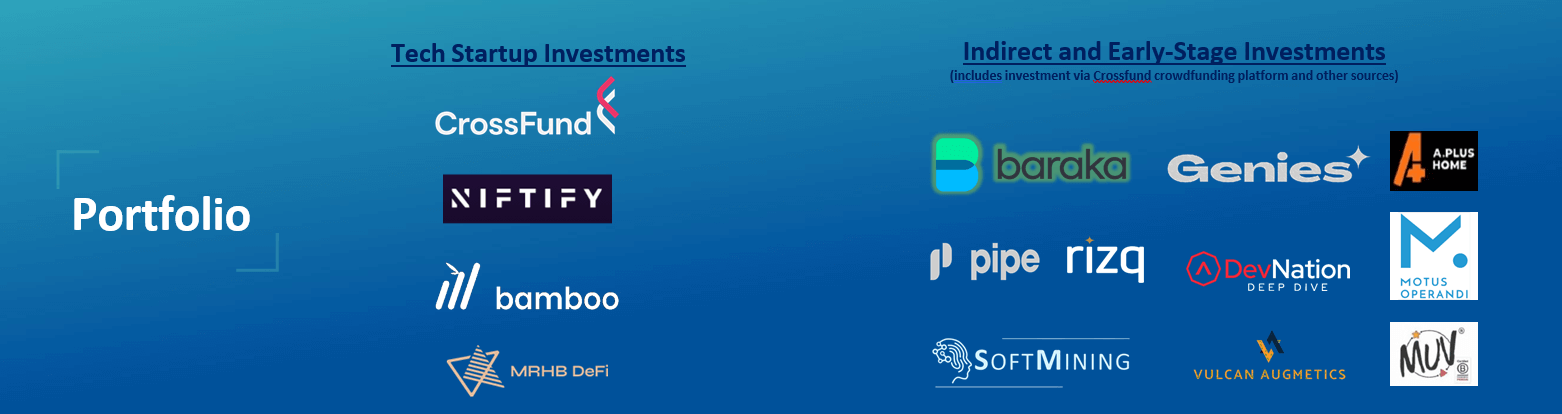

Flagship Fund (AGVCFI) invests in high-potential, tech start-ups from a diversified geographical base that includes USA, Europe, Middle East, Pakistan, Australia, and Africa.

Investment thesis is biased toward the innovative Web3 and Blockchain sectors (such as DeFi, Metaverse, Gaming), scalable FinTech and Ecommerce providers and the rapidly growing Healthtech and Edutech industries. We look for businesses that have amplifying networking effects with experienced founding teams and brilliant ideas.

The Board and IC members include former Chairman, CEOs, and Executives from top tier global investment banks. Collectively, our team has over US$600B of transactional experience.

A MEAP and Australia focused Fund targeting pre-seed to Series A stage venture investment opportunities across various verticals.

Team

- $600B of transactions under the belt

- Former Chairman, CEO and Execs of top Tier Global investment banks

- Fund Manager – founding CFO of a Middle Eastern unicorn

- Versatile skillset that includes investment banking, consulting, legal and advisory

- Global presence and network

Investment Strategy

Predominantly focused on the MEAP and Australia region, a market that experienced a record year-on-year growth in venture capital investments in 2021. Australian Gulf Capital believes the region is emerging as the next frontier for VC investments among the emerging markets.

The fund managers deploy smart capital and leverage portfolio synergies to consistently deliver outperformance to their clients. With each opportunity, they look for exceptional teams, brilliant ideas, scalable businesses, large addressable markets and a defined exit strategy. When investing, they apply the abilities to add value and strive to positively influence commercial outcomes.

Products & Services

A global investment manager leveraging seasoned expertise to execute venture capital investment opportunities that deliver high- value to shareholders.

Diversified investor base with proximity to high-net-worth investors and family offices from the GCC and Australia. The fund specialise in alternative investments and establishing global relationships.

Australian Gulf Capital invests in businesses that have the potential to become industry unicorns. Via a global network, the team has access to opportunities that span the spectrum of some of Tech’s most exciting sectors, including fintech, blockchain, metaverse, gaming, e-commerce, healthtech, edutech and agritech.

Value-Driven Investment Approach

Geography: MEAP and Australia

Fund Size: $100M (1st close $25M)

Fund Life: 7 years (option to extend +2 years)

GP Fees: Management Fees

- First $30M commitment: 2.5% p.a.

- Portion above $30M: 2% p.a.

- 1st anniversary: 2% p.a.

Thereafter, reducing by 10 basis points every anniversary, to a minimum 1.6% p.a.

Carried interest: 20%

Team

Kal Desai

General Partner & Investment and Advisory Committe Member

Anthony D’Silva

Investment and Advisory Committe Member

Marc Aouad

Investment and Advisory Committe Member