Capital Raising

OPEN

CleverCow Global

Fighting climate change through sustainable farming

INDUSTRY

Agriculture

RAISING

A$1M

PRE-MONEY VALUATION

A$7M

MINIMUM INVESTMENT

A$20,000

Investment Highlights

Company Overview

Transaction Overview

Products & Services

Team

Transaction Summary

CleverCow Global

Raising A$1M

Pre-Money Valuation A$7M

Investment Highlights

Company Overview

CleverCow is a ClimateTech company exclusively centred on the agriculture industry. A pre-revenue, early-stage startup business, offering a subscription-based, carbon offset platform directed at consumers.

CleverCow provides an accessible platform for individuals & businesses to contribute to climate action, by giving access to 100% verified carbon credits produced exclusively through Australian sustainable farming practices. By integrating climate technology into agriculture, companies like CleverCow are enabling more efficient management of resources, reducing waste, significantly lowering greenhouse gas emissions, and directly addressing methane reduction, a critical factor in slowing global warming.

That’s why CleverCow was created.

The Business Model

Through our parent company DIT AgTech, our patented technology enables us to feed methane reduction additives in a soluble form alongside our nutritional supplements, tracking emissions directly at the source.

CleverCow provides a reliable platform through which Australian producers can monetise carbon credits they produce – through methane abatement and other sustainable farming practices – creating a stable financial ecosystem for carbon reduction initiatives.

CleverCow aggregates various types of carbon credits that have been produced, the platform retires these credits at purchase, fractionalises them and then onsells part or full credits to individuals or businesses via a subscription model. CleverCow model ensures strong margins for the business and enables additional margins to be reinvested back into the value chain – creating viable new revenue streams for producers to expedite the rate of adoption of sustainable farming practices.

All carbon credits retired via CleverCow are 100% verified under an Australian government or global standard.

Transaction Overview

The Offer

Raising A$1M at a pre-money valuation of A$7M at A$0.25 per share.

Minimum investment amount: A$20,000

The Offer will only be offered to persons to whom a disclosure document is not required to be provided under Part 6D.2 of the Corporations Act 2001 (Cth) (Corporations Act) (which includes ‘sophisticated investors’ within the meaning of section 708(8) of the Corporations Act and ‘professional investors’ within the meaning of section 708(11) of the Corporations Act).

Use of Funds

Marketing & Promotion | Purchase carbon credits across sustainable farming | Platform Development |

|---|---|---|

50%

Fill Counter

| 30%

Fill Counter

| 20%

Fill Counter

|

Products & Services

The CleverCow Platform

CleverCow is a digital platform and subscription service offering users access to verified carbon credits produced exclusively through Australian sustainable farming methods. CleverCow provides ‘environmental impact as a service’ through an online platform.

Subscription-based access

Users subscribe to CleverCow on a monthly or annual basis, paying a recurring fee to offset their carbon footprint. One year of subscription equates to one tonne of carbon dioxide (or the equivalent greenhouse gas) removed from the atmosphere.

One-Off payment & ‘Gifting’ access

Users can select the option of paying a single, upfront cost to access CleverCow by either choosing to retire a select amount, or select price, of carbon credits.

Fractionalisation and Tokenisation System

CleverCow uniquely offers fractionalised carbon credits allowing users to purchase fractions of a whole carbon credit (which equates to one tonne of carbon dioxide, or the equivalent, removed from the atmosphere) lowering the cost of entry to carbon offsetting. Our unique tokenisation system provides secure tracking of all carbon credits throughout their lifecycle, ensuring complete integrity of any carbon transactions made through CleverCow.

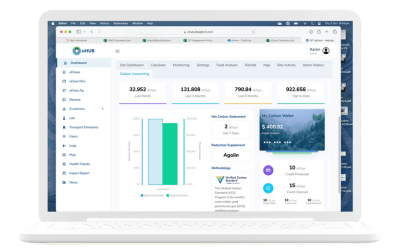

Carbon Measurement and Monitoring Technology

CleverCow leverages parent company DIT AgTech’s precision uDOSE technology and uHUB data dashboard to ensure accurate and reliable monitoring of methane reductions and carbon credits generated through this practice.

- uDOSE Technology: Enables methane reduction additives to be fed into livestock drinking water, ensuring effective dosage, alongside other nutritional supplements.

- uHUB Dashboard: Emissions reduction data, supplement rates, and livestock consumption are automatically recorded and transmitted via satellite to the uHUB dashboard, providing real-time insights.

This automated data collection enhances the transparency and credibility of carbon credits on the CleverCow platform, giving users a trusted tool for monitoring and managing their environmental impact.

Enter your text here...

General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below