Capital Raising

OPEN

ESN Cleer

First early drug treatment for specific Cardiomyopathies to aid in the prevention of Heart Failure

INDUSTRY

Pharmaceutical

Pre-Money Valuation

$20,800,000

RAISING

$500,000

MINIMUM INVESTMENT

$50,000

Investment Highlights

Company Overview

Transaction Overview

News

Transaction Summary

ESN Cleer

Raising $500,000

Minimum Investment $50,000

Investment Highlights

First early drug treatment for specific Cardiomyopathies to aid in the prevention of Heart Failure.

Targeting specific clinical and commercial gaps in the pharmaceutical industry.

Derisked clinically proven repurposed drug ESNtx005; with reduced cost & time towards commercialisation.

Intellectual property of most valued First in Class and Composition of Matter protection.

Ongoing subsidised development costs from the Australian government since 2019, with subsequent incentives expected from the US orphan drug initiative.

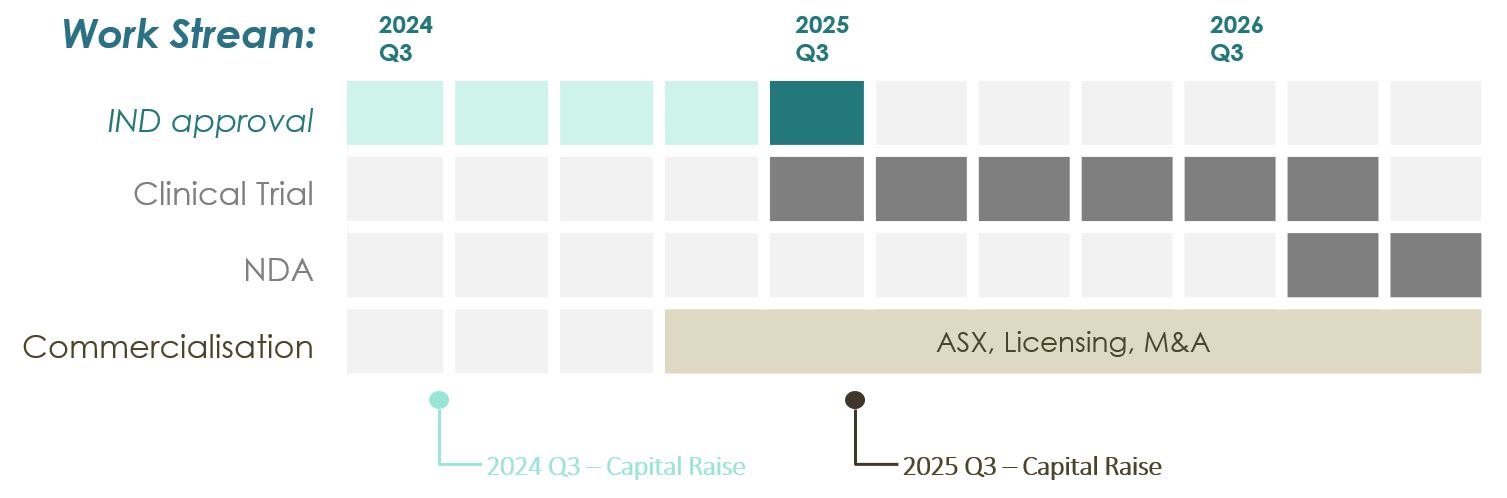

ESNtx005 anticipates IND (FDA) approval in ~12 months.

ASX listing / M&A projected in 2025 onwards and Estimated investors exit-ROI by 2025-26.

Recent notable cardiac-drug transactions and successes in the market include:

Cardior’s €1.025 billion acquisition by Novo Nordisk in March 2024.

Cardior’s lead drug compound was in Phase 2 clinical development for heart failure with reduced ejection fraction (HFrEF).

In October 2020, Bristol Myers Squibb (BMS) completed the acquisition of MyoKardia for a sum of US$13.1 billion.

MyoKardia was in the clinical development stage of its leading drug, Mavacamten (Camzyos), targeting hypertrophic cardiomyopathies (HCM).

FoldRx was acquired by Pfizer in 2010 at an undisclosed amount for its drug, Tafamidis, while in clinical development stage.

Tafamidis is a repurposed drug for cardiovascular application (ATTR-CM, Transthyretin Amyloidosis Cardiomyopathy), gained notable regulatory designations, including:

- Fast Track review status

- Orphan drug designation

- First-In-Class drug designation

Revenue of US$3.3 billion in 2023 with 36% growth year on year.

Company Overview

Established in 2018, ESN Cleer is led by globally renowned Heart Failure cardiologist and pharmaceutical entrepreneur, supported by an experienced multidisciplinary team. ESN Cleer’s commitment to advancing heart disease treatment and prevention is the foundation towards its ESNtx005 development.

ESN Cleer transitioned to an unlisted public company in 2020, enabling broader investor access while ensuring corporate regulatory compliance. ESN Cleer is currently in clinical phase with ESNtx005; a repurposed orphan drug targeting the rare disease Restrictive Cardiomyopathy; a first early drug treatment for specific Cardiomyopathies to aid in the prevention of Heart Failure.

ESN Cleer has established a network of global clinical and commercial partners towards its development and commercialisation strategies. ESNtx005 have received validation from leading industry experts on its development, IP, regulatory and commercialisation pathways.

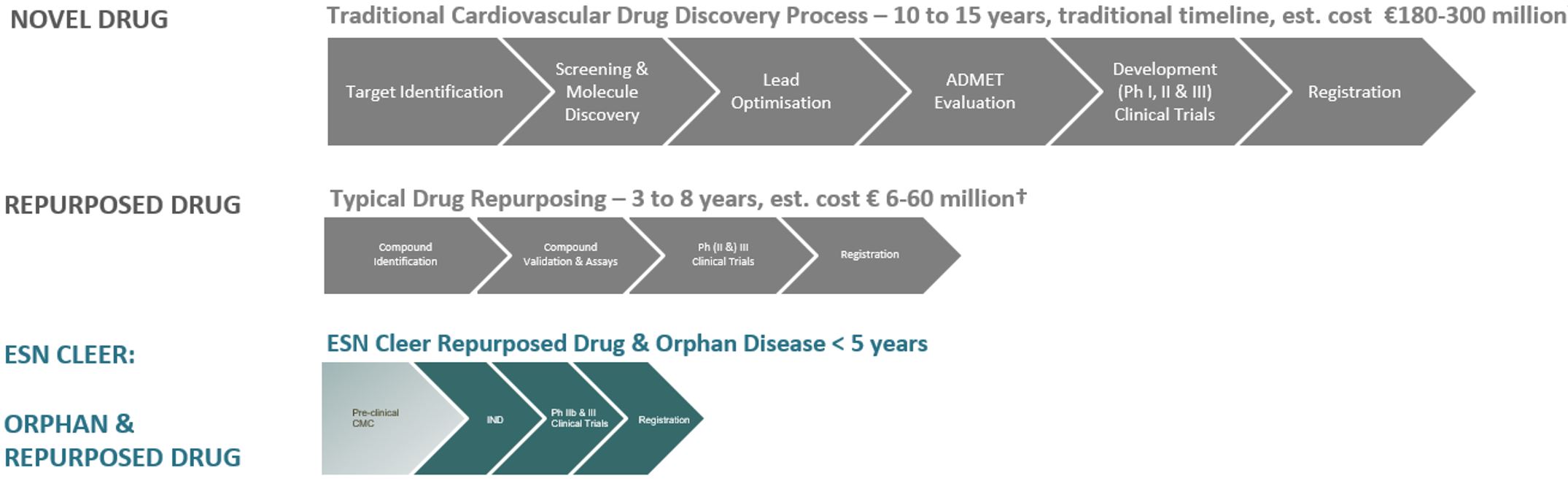

ESN Cleer is delivering significant clinical impact through a novel repurposed drug approach, reducing risks, costs, and accelerating the regulatory timeline for commercialization.

ESN Cleer's extensive research led to the discovery and development of ESNtx005, achieving a 99% purity level and securing a Composition of Matter patent for its unique synthesis method and impurity fingerprint, while expanding its intellectual property portfolio with multiple patents, including two filed in the past year.

The proprietary drug ESNtx005, based on a proven off-patent compound, targets orphan indications for the rare disease Restrictive Cardiomyopathy (RCM), which currently lacks specific therapeutic treatments, leaving many patients untreated despite available diagnostic tests.

The Restrictive Cardiomyopathy Problem

ESN Cleer aims to innovate drug discovery and commercialization by reducing risk through novel repurposed drug development. In alignment with high-demand market segments benefiting from regulatory incentives and optimizing clinical trials with legacy biomarkers to enhance cost efficiency and expedite timelines.

ESN Cleer's development strategy for ESNtx005 leverages an expedited regulatory pathway, aiming to reduce significant clinical trial time and costs towards its targeted RCM indications, with potential further optimizations compared to industry standards.

ESN Cleer’s commecialisation strategy is an out-licensing and M&A (mergers & acquisition) model, benefiting from pharmaceutical companies' growing focus on orphan drugs and government incentives, with ESNtx005 projected to generate $6 billion in sales within six years of FDA approval, as the orphan drug market is expected to exceed $300 billion by 2028.

The Oprhan Drugs Market

ESNtx0005 is most valuable to fulfill the sought-after clinical (1st RCM drug treatment) and commercial (IP-protection, IRA-price protection, Rapid Market Access-reduced R&D expenditure) gaps of the pharmaceutical industry.

Pharmaceutical Challenges

Products

ESN Cleer’s ESNtx005 is to address the most significant problems in:

- Heart Disease is a complex disease with multiple root causes – many are without specific treatments.

- New Drug treatments, high risk, cost and time to develop

- Pharmaceutical Industry Challenges,

- Patent Cliff

- Inflation Reduction Act 2022 (IRA)

- Reduced Internal R&D and major pharmaceutical companies

ESNtx005

ESN Cleer’s novel repurposed drug, ESNtx005, is the first therapeutic treatment specifically targeted to Restrictive Cardiomyopathy. ESNtx005’s multiple mode of actions has a legacy of clinical trials achieving superior efficacy compared to market competitors in Heart Failure patients and an animal-model study showing exceptional benefits in the related Dilated Cardiomyopathy (DCM) condition.

Its features include:

- Commercial advantages include:

- Fast Track review status

- Orphan drug designation

- First-In-Class drug designation - Opportunities include optimizing clinical trials, enhancing therapeutic efficacy, and minimizing adverse risks.

- Proven efficacy and superior to class competitors in Heart Failure (HF)

- Targeting Restrictive Cardiomyopathy (RCM)

- 15,000 humans recruited in past clinical trials within HF syndrome

- Clinical profile well understood

- Positive Freedom To Operate (FTO)

- New formulation covered by ESN Cleer patent - Novel Composition of Matter

Investor Webinar Presentation - October 2024

Transaction Overview

Terms of offer:

ESN Cleer is currently raising A$500,000 at a pre-money valuation of A$20.8 million, by way of ordinary shares. The current capital raise allows for potential oversubscription, meaning that if there is strong demand from investors, the company may raise more than the initial target of A$500,000. This capital funding will support key initiatives and further advance ESN Cleer's strategic goals in drug development towards commercialization and investors’ ROI.

USE OF FUNDS

Working Capital | Regulatory | IP & Legal | R&D Delopment |

|---|---|---|---|

5%

Fill Counter

| 12%

Fill Counter

| 33%

Fill Counter

| 63%

Fill Counter

|

Previous Funding

Since 2018, ESN Cleer has raised over A$5 million in capital, including approximately A$1m from notable lead investors. The lead investors include institutional and Key Opinion Leaders (KOL), such as WS Investments from the US, Jinding Investments and medical-specialists KOL group.

The company has also secured non-dilutive capital through Australian government grants (IMCRC and VHI) and has consistently received rebates covering 45% of its R&D expenditure through the R&D Tax Incentive since 2019.

In February 2024, ESN Cleer raised A$500,000, with its current capital raise intended to support advanced chemistry work and preparations for the ESNtx005 Investigational New Drug (IND) application with the FDA. Regulatory advice from Armstrong Clinical confirms that ESNtx005 will not require a lengthy or costly clinical trial prior to USFDA IND submission, reducing both time and expenses. Achieving the IND submission milestone within the next 12 months is projected to provide ESN Cleer's valuation up-lift, opening access to further capital and exit opportunities.

Additional Information

Team

General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below