Capital Raising

OPEN

Hydrogenus Energy Limited

Renewable energy investment opportunity

INDUSTRY

Energy

RAISING

A$2M

PRE-MONEY VALUATION

A$6.5M

OFFER PRICE

A$2.00

Investment Highlights

Company Overview

Transaction Overview

Additional Information

Team

News

Transaction Summary

Hydrogenus Energy Limited

Seeking A$2M

A$2.00 per share

Investment Highlights

Zero Carbon electricity, on demand, at a lower cost

Seeking $3M in equity, of which about $0.6M either received or firmly promised, with a potential major investor currently under-taking Due Diligence to invest up to $2M in about AprilPre-IPO opportunity – Seeking a listing mid-2024

Agreed, but un-executed (due to Christmas break) Letter of Intent from 2 organisations for up to 6 projects, at least 2 of which are to be operational mid-2024

Company Overview

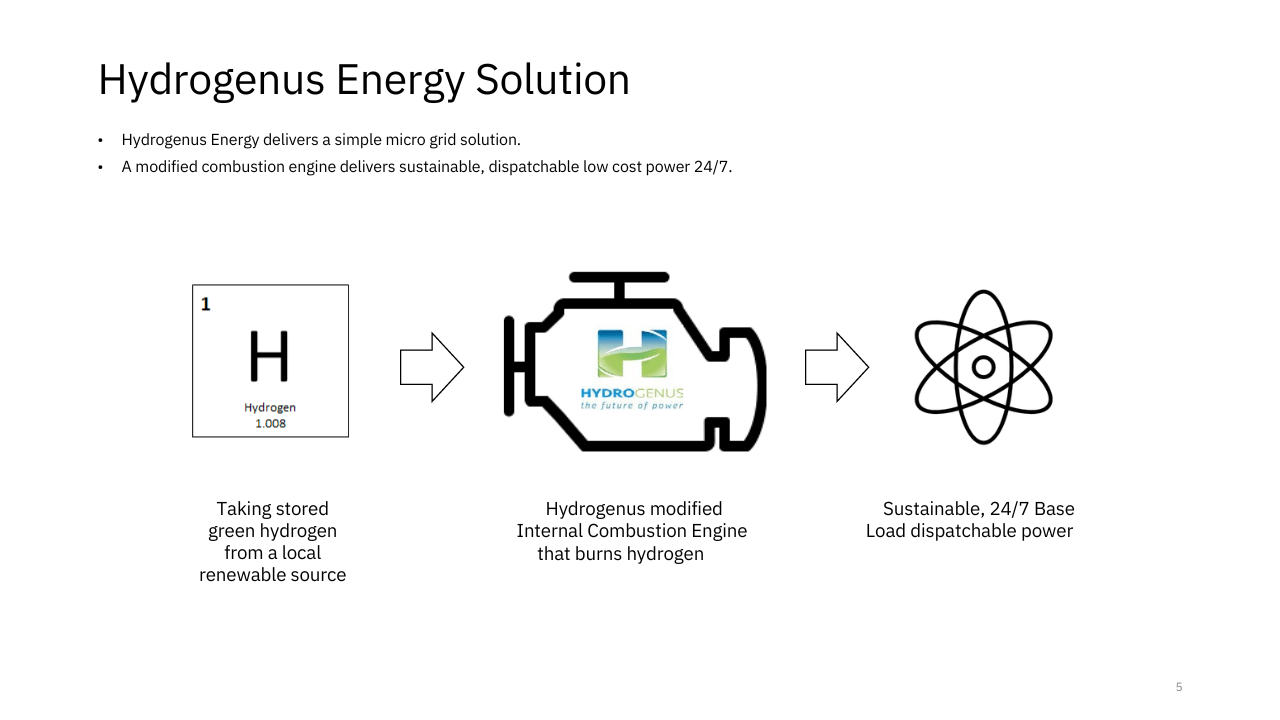

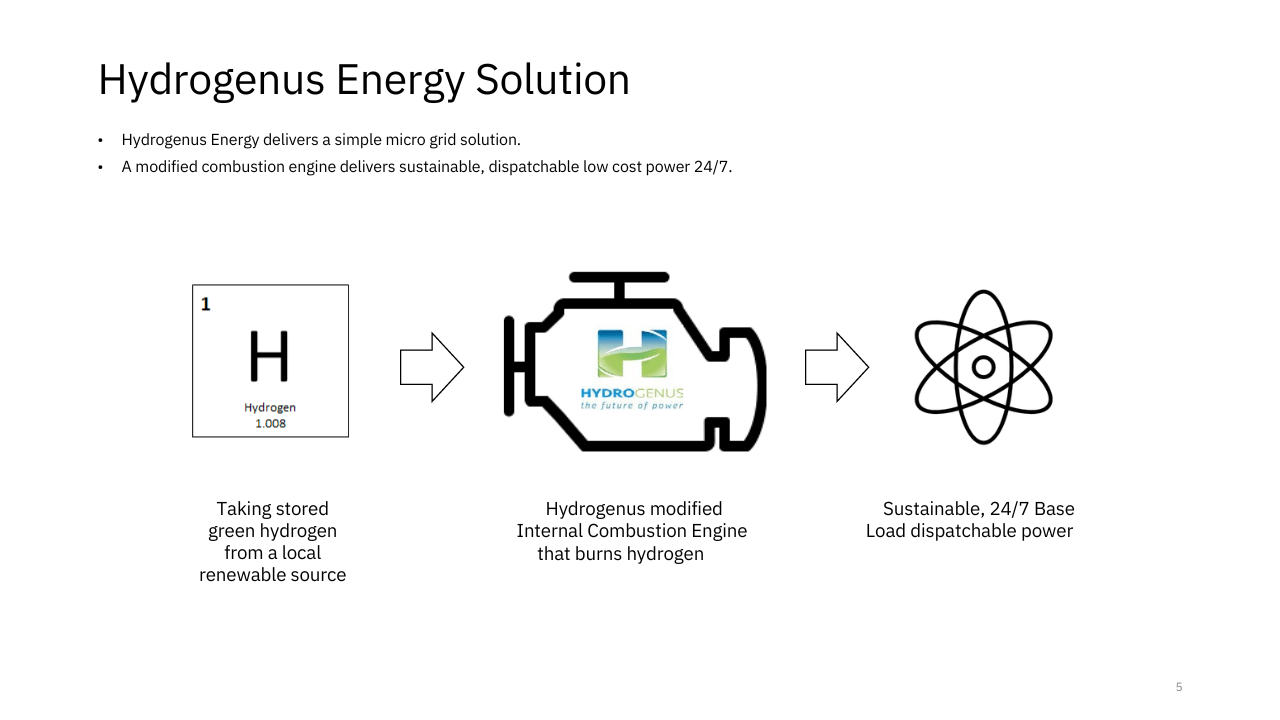

Hydrogenus Energy (HYE) has developed an engine that operates safely, effectively and efficiently using hydrogen as its only fuel. We developed our engine to be part of a system, as shown in the diagram below, to be part of a system to provide carbon (and NOx and SOx and particulate) free electricity on demand at a lower cost than other on-demand systems for off-grid areas.

All components in our system are either presently commercially available or have been technically de-risked. While the integrated energy management system needs to be developed, this is a small enhancement of systems that have been previously developed and are currently commercially deployed.

HYE intends to be a project generator, executing a first pass assessment of a project, establishing either significant projects or a suitable bundle of projects as a Special Purpose Vehicle (SPV) before bringing in project engineers and debt and equity providers into the SPV to execute the project, with HYE as the manager of the project.

There are up to 5 potential sources of revenue :

- Professional fees for the modification to Internal Combustion Engines required for a project;

- Management fees plus fees for the lease of our IP to each project;

- Returns to equity investors in projects;

- Some share of the difference between the cost of the Hydrogenus Energy system and the next lowest cost system, and

- Some share of the value of Green Energy and / or Hydrogen Certificates applicable to each project.

The first 2 of the above accrue total to HYE, while the third depends on the share of equity investment made and the (iv) and (v) are expected to be shares between HYE, project equity investors and the client of each project.

In 2021, 720m MWh of electricity was produced globally from liquid fuels, costing about USD 194 billion, accounting for about 3.3% of global oil consumption and producing about 520Mt of CO2, or 1.4% of estimated global anthropogenic CO2 emissions. We estimate our Addressable Market to be about 40% of this total.

HYE is able to identify expected improvements in related technologies of wind turbines, solar panels and electrolysers are expected to reduce our costs so that our system can become competitive with distributed grid electricity prices.

Developing renewable energy solutions

Hydrogenus Energy (HYE) has developed an engine that operates using Hydrogen as its only fuel. HYE’s engine

- Is robust with respect to the quality of hydrogen that can be produced on site;

- Has zero carbon (and NOx and SOx and particulate) emissions;

- Is more efficient than any other gas or liquid fuelled engine of a comparable size;

- Is robust and easy to maintain and service and we can expect long life;

- Copes with changes in load better than any other engine;

- Stays in better control than any existing engine responding to changes in load; ie. the output is consistent.

The engine was developed to be part of a system that delivers electricity on demand at a lower cost than other, on-demand systems, such as diesel generators.

In 2021, 720m MWh of electricity was produced globally from liquid fuels, costing about US194B, accounting for about 3.3% of global oil consumption and producing about 520Mt of CO2, or 1.4% of estimated global anthropogenic CO2 emissions. We estimate our Addressable Market to be about 40% of this total.

Australia has about 0.6% of this Total Addressable Market, while Pacific Islands is about 2x the Australian market.

HYE is aware of developments in related technologies, including solar panels, electrolysers and wind turbines, that promise to reduce our costs by about 30%, to about the price for distributed electricity, making our potential market significantly larger.

Commercialisation

HYE has received interest from a globally significant manufacturer of diesel engines for a licence to use our Intellectual Property. The attraction is our engine’s responsiveness and its low pressure injection, making our engines cheaper, less complex and more robust that high pressure injection engines.

HYE is in the process of preparing patent applications, which we expect will be lodged in January 2024, and other protections of our IP.

This attests to the technical proficiency of our engines.

HYE has agreed Letters of Intent from 2 organisations, representing up to 6 projects, if which 2 are to be operational by mid 2024, to use our IP.

Transaction Overview

USE OF FUNDS

Opportunities | Marketing | Product Development | General Corporate |

|---|---|---|---|

17%

Fill Counter

| 12%

Fill Counter

| 40%

Fill Counter

| 31%

Fill Counter

|

News

General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below