Capital Raising

CLOSED

New Generation Minerals

Developing a state-of-the-art nickel mining & processing in WA hub to feed soaring battery metal demand

INDUSTRY

Technology

Investment Highlights

Company Overview

Products & Services

Transaction Overview

Additional Information

Team

News

New Generation Minerals

This offer closed September 2023. If you would like to discuss anything in relation to this company please contact us for further information.

All information on this page was current as at the date of closure.

Investment Highlights

Developing a Western Australia nickel processing hub unlocking millions of tonnes of stranded deposits within a 100km radius

Building low energy and environmental footprint nickel processing plant in the best mining location in the world

Patented and proven DNI™ processing technology to supply car and battery manufacturers

The market demand, the technology, and the ore - intend to IPO on ASX in Q4 2023 and build and commence operations within five years

Company Overview

Nickel and cobalt are critical metals underpinning the energy transition. Global battery demand requires more nickel and cobalt capacity for electric vehicles and solar energy storage.

Key international battery supply chains require ethical and low environmental footprint mining and processing. Western Australia is the leader in mining standards and the world’s No. 1 region for mining investment. North America does not have large reserves; major car and battery manufacturers are looking to Western Australia to do direct sourcing deals.

NGM Australia has a surface-lying nickel-cobalt JORC resource in Western Australia at Lake Yindarlgooda, ready for expansion through infill drilling.

NGM Australia will build a new nickel-cobalt mining and processing hub in the heart of Western Australia’s nickel reserves to unlock value from its own resource and surrounding ore on a tolling basis. This will be a fully integrated project comprising mining and processing

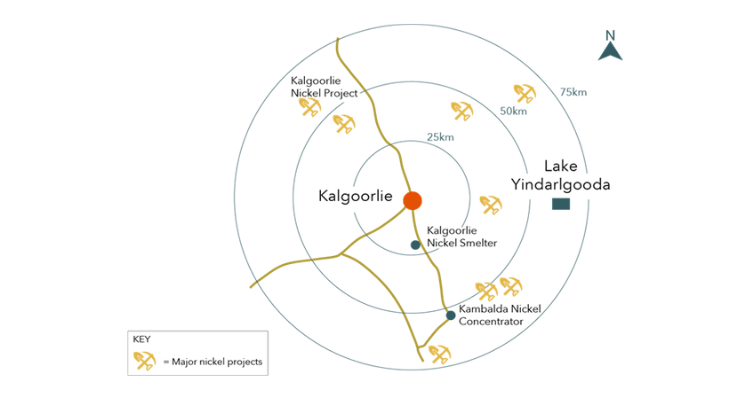

The region has a logical demand for a specialist processing plant. Within a 100km radius, there are numerous deposits without a processing solution. Our plant will unlock this stranded ore. NGM Australia will process the company’s own ore (from Lake Yindarlgooda) and tolling ore to deliver a +30-year ore feed to load the plant from other regional deposits. In August 2023, the Company signed an MoU with Riversgold (ASX: RGL) for the right to explore for nickel and cobalt over a 364 square km tenement package. NGM Australia intends to further expand its access to nickel ore by entering into similar arrangements with other regional nickel tenement holders; ultimately targeting production of more than 16,000 tonnes of nickel and cobalt sulphate per year.

The processing plant will be enabled by patent protected DNiTM technology from Altilium Group for extracting nickel and cobalt at lower temperatures and pressures, fulfilling long term demand for low energy footprint and ethically sourced nickel and cobalt for use by global battery makers. The DNi™ Process is described by Altilium as a “ground-breaking method for extracting nickel, cobalt and other constituted metals contained in laterite ore.”

DNi™ technology has already been de-risked by Queensland Pacific Metals (ASX), which is proceeding with a A$2.1B project based on the technology. It was reported that their project presents strong financial metrics and they have already secured offtake agreements for 100% of nickel and cobalt for the life of the project.

Concept economics for NGM Australia’s operation have been completed and are attractive based on well considered project assumptions.

NGM intends to IPO on ASX in Q1 2024, with PAC Partners now engaged as broker, and build and commission mining operations and processing within five years from IPO.

To date NGM Australia has been seed funded by its parent company, New Generation Minerals, an established metals exploration company with four prime location projects in Western Australia.

Products & Services

Subject to metallurgical modelling and final process design, the processing hub should produce the following saleable products:

Nickel-Cobalt MHP or Nickel Sulphate

High-Purity Alumina (HPA)

Magnesia

Hermatite

Sale of these products will be secured through agreements with strategic off-takers.

Want to learn more?

Fill in the expression of interest form below