Capital Raising

CLOSED

Orion Resources Pty Ltd

Processing Plant

Permitted Mines

High Gold Price

INDUSTRY

Resources & Mining

Investment Highlights

Company Overview

Transaction Overview

Products & Services

Team

Announcements

Transaction Summary

Orion Resources Pty Ltd

Raising A$2.5M

$25,000 minimum investment

This offer closed September 2025. If you would like to discuss anything in relation to this company please contact us for further information.

All information on this page was current as at the date of closure.

Investment Highlights

This is a cashflow focus project, restarting existing mines and building a long-term project pipeline using standard and proven industry stage-gate practices.

Permitted, Near-Term Production Asset

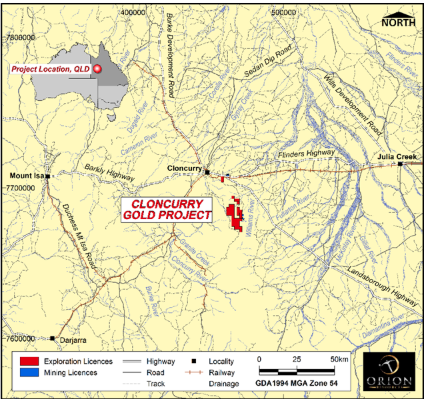

- Orion Resources has secured rights to acquire the Cloncurry Gold Project, including 20 mining tenements and the fully permitted Lorena Gold Processing Plant, Orion has spent $4m to date in deposits and holding costs.

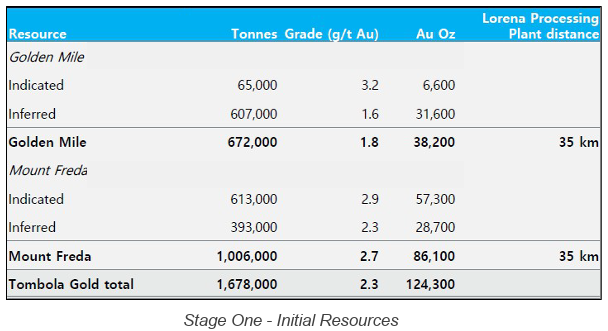

JORC 2012 Resource with Expansion Potential

- The project hosts a JORC 2012 Indicated and Inferred resource of 1.68Mt @ 2.3g/t for 124.3koz Au, including the flagship Mt Freda deposit and multiple near-mine prospects (e.g. Golden Mile, Mt Scheelite).

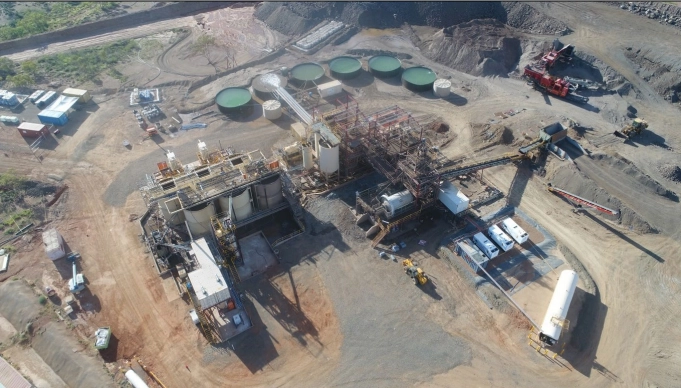

Processing plant

- Located 38km from Cloncurry. 300ktpa nameplate capacity, CIL and Flotation circuits for both oxide and sulphide ore.

Restart-Focused Strategy with Early Cash Flow

- Orion’s development plan focuses on restarting gold production within 12–18 months using existing infrastructure, therefore low restart capex , after delineating a maiden JORC-2012 Reserve for high-confidence economic returns.

Strategic Partnership with ASX-Listed AuKing Mining (ASX:AKN)

- AuKing is acquiring a 50% stake in Orion via a A$5M earn-in agreement providing Orion with access to public market capital to accelerate the Cloncurry Gold Project.

Well-Defined Exit Strategy

- Orion intends to pursue an IPO or RTO (reverse takeover) within 12 months, with conversion rights for early investors at a 40% discount to an IPO or RTO share issue price, providing potential for significant upside.

Attractive Convertible Note Terms with NSR Upside

- Investors receive 18% p.a. cash yield, pro-rata share of a 1% Net Smelter Return (NSR) on the first 80koz of production, and an equity conversion discount of 40% to any IPO, RTO or listed merger share issue price.

Company Overview

Orion Resources Pty Ltd is an emerging Australian gold developer focused on restarting production from the Cloncurry Gold Project in Queensland. The project comprises:

- A fully permitted CIL gold processing plant (Lorena) with ~300ktpa capacity, independently valued at A$12.6M (replacement >A$30M).

- 20 granted tenements across 447km², including granted MLs and ELs with both near-mine and regional exploration potential.

- Flagship gold deposits Mt Freda and Golden Mile, both located on granted mining leases and previously mined.

- Upon completing settlement on the acquisition, Orion intends to delineate a JORC-2012 compliant maiden Reserve for its first project (Mt Freda) prior to recommencing operations.

- Expected time frame for the maiden Reserve is 7-9 months. Production decision expected in approximately 12 months.

- Focus is on cash flow and building a robust pipeline for continued mill feed and inventory growth using a proven hub-and-spoke business model.

- Prior operator scoping study demonstrates a robust project with strong free cash flow.

- In 2025, Orion commissioned a cost model update based on the prior owner’s 2023 Scoping Study. The revised cost model confirmed robust economics at scoping level:

- Gold Price: USD$2750 oz (LOM)

- LOM FCF: A$70M

- Stage One LOM production: ~35koz Au over 2 ½ years

- Cautionary statement: Scoping Study level results provide a high-level preliminary economic assessment only – they do not purport to represent Feasibility-level forecasts

The project team brings over 175 years of combined mining experience, including backgrounds at Barrick, Placer Dome, and Newcrest. Orion’s approach prioritizes feasibility-backed planning, staged capital deployment, and asset-level derisking before production.

Transaction Overview

Target Exit Strategy:

- Listing via IPO or RTO within 12 months

- Project restart within 18 months of funding completion

- Settlement of the Cloncurry Gold Project acquisition is targeted for August 2025.

- Settlement fund required after completion of the current convertible note offer is $10.4m (GST ex.)

- Settlement funding is intended to be from a combination of a 3-year acquisition debt facility and earn-in equity from AuKing Mining Limited.

Institutional Co-Investor: Orion has signed a non-binding term sheet for A$8M acquisition finance and first rights on future project debt with Nebari Natural Resources Fund (US), a leading North American specialist mining fund. Formalisation of the acquisition funding facility is targeted for August 2025, subject to satisfying the required conditions precedent under the agreement. Orion is confident of being able to meet the conditions.

Listed Co-Investor: Orion executed an earn-in agreement with AuKing Mining Limited (see AKN announcement of 4 Mar 2025) for AKN to invest $5m into the Cloncurry Gold Project in return for a 50% shareholding in Orion.

Team

Juli Hugenholtz

Director Geology

Paul Turner

Founding Director

Aldo De Luca

Finance Director

General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below