Trading

Federation Alternative Investments

Federation has a track record of producing outstanding returns

INDUSTRY

Financial

STATUS

Trading

OPEN TO

Public

Investment Highlights

Company Overview

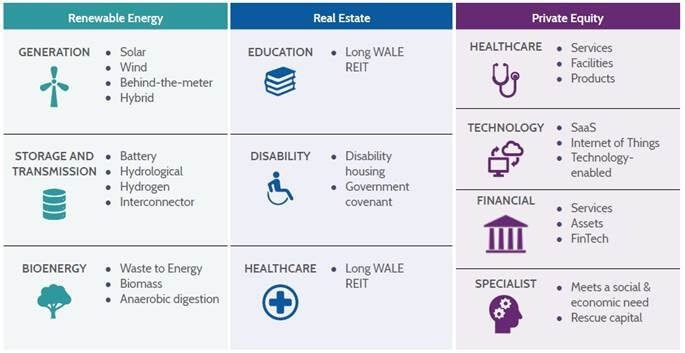

Federation Alternative Investments (FAI) is an Asia-Pacific private equity fund that invests in renewable energy, social, health and education, real estate and high-growth operating companies that meet a social and economic need.

Federation builds strong, sustainable, market-leading businesses through capital provision, strategic, analytical and operational support from years of experience.

Federation is a signatory to the United Nations Principles for Responsible Investment and is a member of the Responsible Investment Association of Australasia.

Since the fund’s inception in September 2018, Federation has committed to A$170M of investments that have generated an IRR return of 27% to date.

Target Return Objective

The Investment Manager seeks to acquire investments that support FAI’s total return objective of 15% per annum (after taking into account fees and costs of FAI but before taxation) over the life of FAI.

Target Yield Objective

The Investment Manager seeks to acquire investments that support FAI’s average income distribution yield objective of 3% per annum (after taking into account the fees and costs of FAI but before taxation) over the life of FAI.

The Opportunity Funds

Renewable Energy: Climate change is one of the greatest challenges affecting our planet. Federation considers the production of clean energy as one of the key requirements to help solve this dilemma.

Real Estate: Real Estate is an integral part of our investment strategy. We pride ourselves on establishing, growing, and maintaining long-term relationships with all real estate stakeholders.

Team

Ask us a Question

Send us a message and we'll connect soon

Become a member

Become a member and elevate your experience with us!

Already have an account? Login