Trading

Klarna

Making it easier for people to shop online

INDUSTRY

Technology

STATUS

Trading

OPEN TO

Public

Investment Highlights

Providing more flexible shopping online to 147 million global active consumers, across more than 400,000 merchants in 45 countries

Platform has supported merchandise transactions over US$80bn

Klarna’s is helping the World’s leading merchants including H&M, IKEA, Expedia Group, Samsung, ASOS, Peloton, Nike, Sephora and AliExpress, among many others

Company Overview

Making online shopping easier

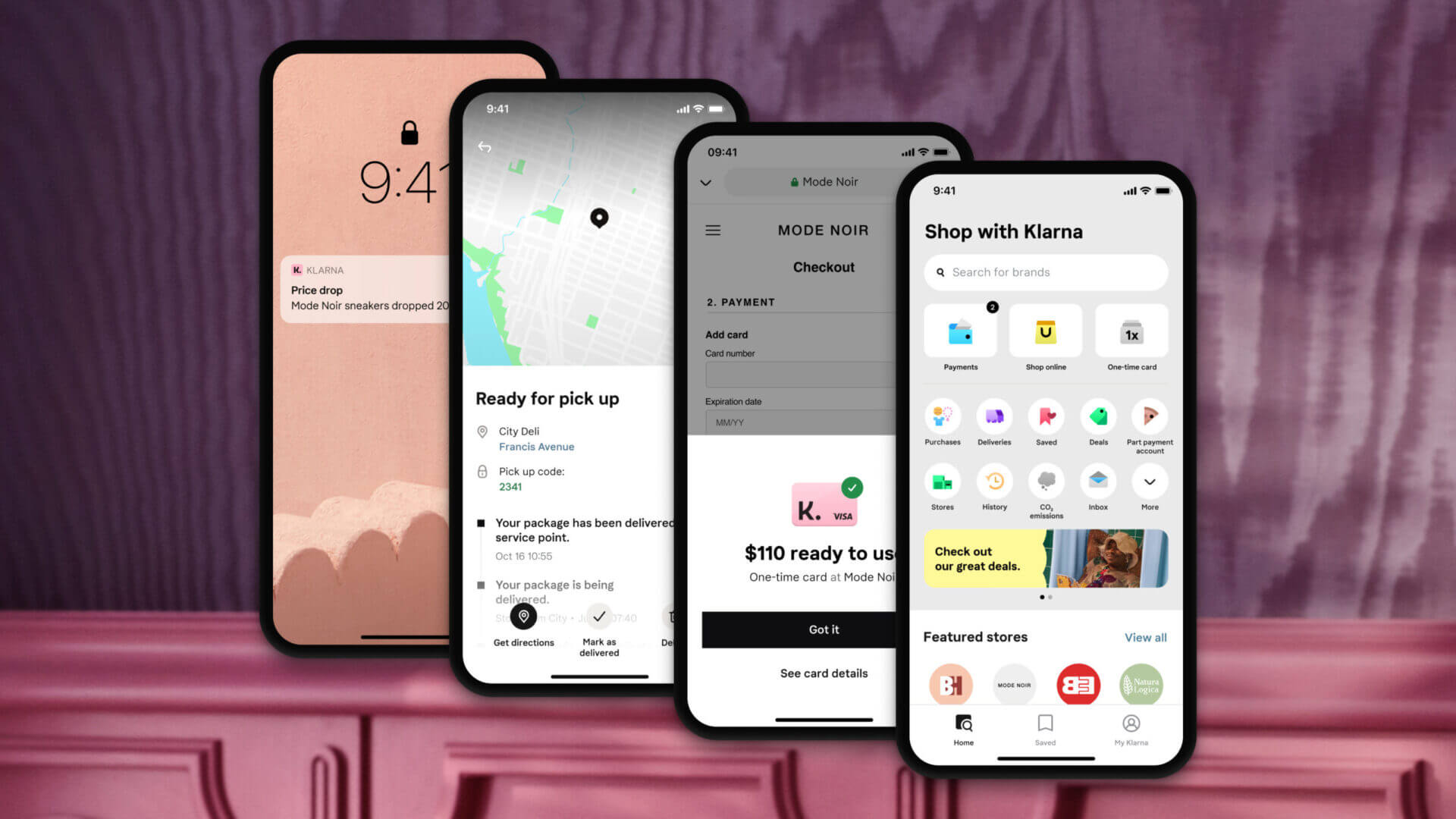

Klarna has a single aim: Making it easier for people to shop online.

Klarna, founded in Sweden in 2005, is the leading global payment and shopping service. Providing smarter and more flexible shopping and purchase experiences to 147 million global active consumers, across more than 400,000 merchants in 45 countries.

Their platform and services have supported merchandise transactions topping volumes over US$80bn.

Klarna offers direct payments, pay-after-delivery options and installment plans in a one-click purchase experience that lets consumers pay when and how they prefer.

Working with the world’s biggest brands and retailers

Klarna is helping the World’s leading merchants to deliver innovative shopping experiences online and in-store, including H&M, IKEA, Expedia Group, Samsung, ASOS, Peloton, Nike, Sephora and AliExpress, among many others.

Their Mission Statement is “On a mission to liberate humanity from the meaningless time spent managing their purchases, so they can do more of what they love.”

Klarna is now one of the most highly valued private fintech globally with a valuation of US$45.6B, as of 2021.

Key Information

Unicorn Companies on the PrimaryMarkets Platform: USA-based Companies with an estimated market capitalisation in excess of US$1B.

Trading in these securities entails compliance with USA regimes such as FINRA and SEC as well as possible ROFR (Right Of First Refusal) imposed by many Unicorns.

All Traders must be Sophisticated, Professional, Institutional, and Accredited Investors and minimum trade size is US$250,000

Please Note: ‘Subject to pre-emptive rights and execution of approved transfer documentation’

Additional Information

Team

Sebastian Siemiatkowski

CEO

David Fock

Chief Product Officer

Koen Koppen

Chief Technical Officer

Niclas Neglen

Chief Financial Officer

Ask us a Question

Send us a message and we'll connect soon

Become a member

Become a member and elevate your experience with us!

Already have an account? Login