Trading

ThoughtSpot

Search & AI Analytics platform for enterprises

INDUSTRY

Technology

STATUS

Trading

OPEN TO

Public

Investment Highlights

Earned ~US$100M in revenue in 2021

High profile customers include industy leaders Walmart, BT, Daimler, Medtronic, Hulu, Royal Bank of Canada, Nasdaq

Built by engineers with experience at Google, Oracle, Microsoft, Yahoo, and other major tech companies

Use by Walmart, BT, Daimler, Medtronic, Hulu, Royal Bank of Canada, Nasdaq, OpenTable, and many more

Company Overview

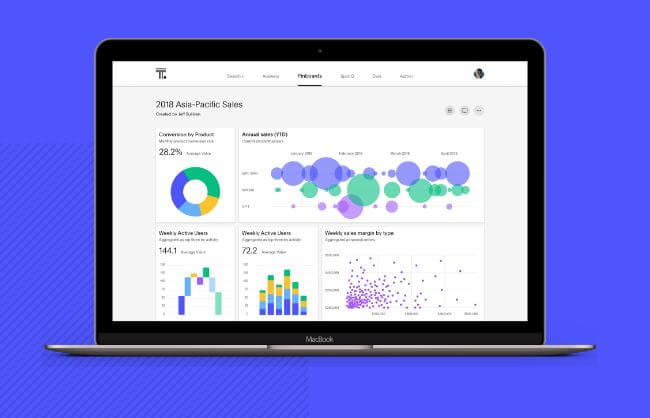

Consumer-grade analytics for everyone at your organization

Analytics tools should be as intuitive as your favorite consumer app

Now anyone can create new insights at the speed of thought

Search Data lets you use natural language query (NLQ) to create a new insight without knowing any SQL

ThoughtSpot is a Modern Analytics Cloud company. Their mission is to create a more fact-driven world with the easiest-to-use analytics platform.

ThoughtSpot makes it possible for anyone to use search and AI to find hidden insights in their company data and puts the most innovative technologies from across the cloud ecosystem in the hands of your entire team.

Built to be used by anyone, the developer-friendly platform lets you embed actionable insights into your favourite applications, or you can build entirely new interactive data apps.

Founded By Silicon Valley Engineers

ThoughtSpot was founded in 2012 by a team of engineers working for Google, Oracle, Microsoft, Yahoo, and other Silicon Valley companies.

CEO and Co-founder, Ajeet Singh, previously co-founded NutaniThoughtSpot, a business intelligence platform helping anyone explore, analyze, and share real-time business analytics data.

The company is based in Sunnyvale, California with additional offices in London, Bangalore, India, Seattle and Tokyo.

The Simple way to leverage your business data

With ThoughtSpot, anyone can leverage natural language search and AI to find data insights and tap into the most cutting-edge innovations the cloud data ecosystem has to offer.

Companies can put the power of their modern data stack in the hands of every employee, extend the value of their data to partners and customers, and automate entire business processes.

Customers can take advantage of our web and mobile applications to improve decision-making for every employee.

Unicorn Companies on the PrimaryMarkets Platform:

USA-based Companies with an estimated market capitalisation in excess of US$1B.

Trading in these securities entails compliance with USA regimes such as FINRA and SEC as well as possible ROFR (Right Of First Refusal) imposed by many Unicorns.

All Traders must be Sophisticated, Professional, Institutional, and Accredited Investors.

Minimum trade size US$250,000

Ask us a Question

Send us a message and we'll connect soon

Become a member

Become a member and elevate your experience with us!

Already have an account? Login