Case study

Tyro Payments

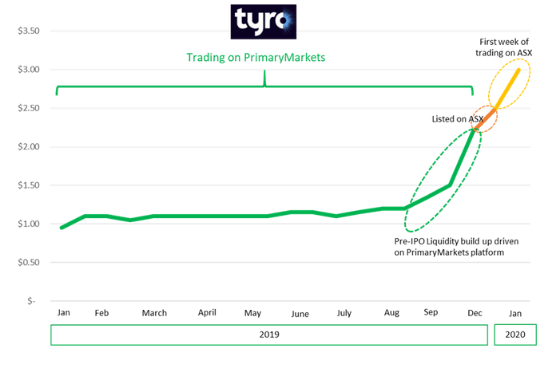

How Tyro Payments Trading Hub helped them build liquidity and prepared them for a successful IPO

After Listing on PrimaryMarkets

PrimaryMarkets successfully traded over A$38M pre-IPO

Market capitalisation of Tyro grew from A$380M to over A$1B

Tyro shares peaked at A$2.20 per share, up 275% since they listed on PrimaryMarkets

PrimaryMarkets trading helped Tyro adequately prepare for an ASX listing by facilitating shareholder support & liquidity

Who are Tyro Payments?

Tyro Payments (ASX: TYR) offer many services, from EFTPOS solutions to streamlined business loans and banking products, helping thousands of Australian businesses to grow and thrive.

They are Australia’s largest EFTPOS provider, outside the Big 4 banks, and handled over A$20B transactions in FY20 at a 24% transaction compound annual growth rate.

Tyro provides tailored EFTPOS, effortless business loans and banking solutions that support over 36,000 Australian businesses. Beyond credit, debit and EFTPOS card acquiring, they also offer Medicare and private health fund claiming and rebating services.

Why Did Tyro Payments Setup a Trading Hub for Secondary Trading?

In 2016 Tyro Payments set up a secondary market with PrimaryMarkets to allow early investors to liquidate some, or all, of their holdings.

Early investors had seen their holdings grow significantly, and while they still wanted to hold most of their Tyro shares, they did seek a market to help rebalance their holdings.

By offering secondary market trading Tyro drove liquidity for shareholders and attracted new investors with a promise of an active market for shareholders.

Trading Hubs unlock liquidity for unlisted companies and their shareholders

Find out more about how PrimaryMarkets Trading Hubs can help your unlisted company

Tyro Payments Pre-IPO Trading on PrimaryMarkets

Tyro Payments were listed on PrimaryMarkets at A$1.07 in 2016. Over the following years price discovery on the Platform saw consistent growth in the value of shares as the company’s operations expanded.

Tyro reached a peak of A$2.00 per share in September 2019, just prior to their announcement to IPO at a price of A$2.75.

When Tyro listed on PrimaryMarkets its market cap was approximately A$380M, growing to over A$1B by the time they sought to IPO.

Key Information

Australia's largest EFTPOS provider of all ADIs outside the big four banks

Tyro Payments have 6,000 customers and still growing

More than A$34B in transaction value processed in FY22

A 26% Y0Y transaction volume compound growth rate