Case study

Animoca Brands

How an NFT gaming leader became a Unicorn in 2021 by offering private shareholder liquidity

Animoca Brands Journey from Delisting to Unicorn Status

When Animoca Brands was faced with delisting from the ASX in March 2020 it seemed like its most likely path to success had evaporated.

Fast forward to 2023 and they have reached Unicorn status many times over, becoming a leader in online gaming.

Find out how they leveraged their unlisted status to ignite liquidity, and their valuation, through a private Trading Hub.

What Happened After Animoca Brands Opened their Trading Hub

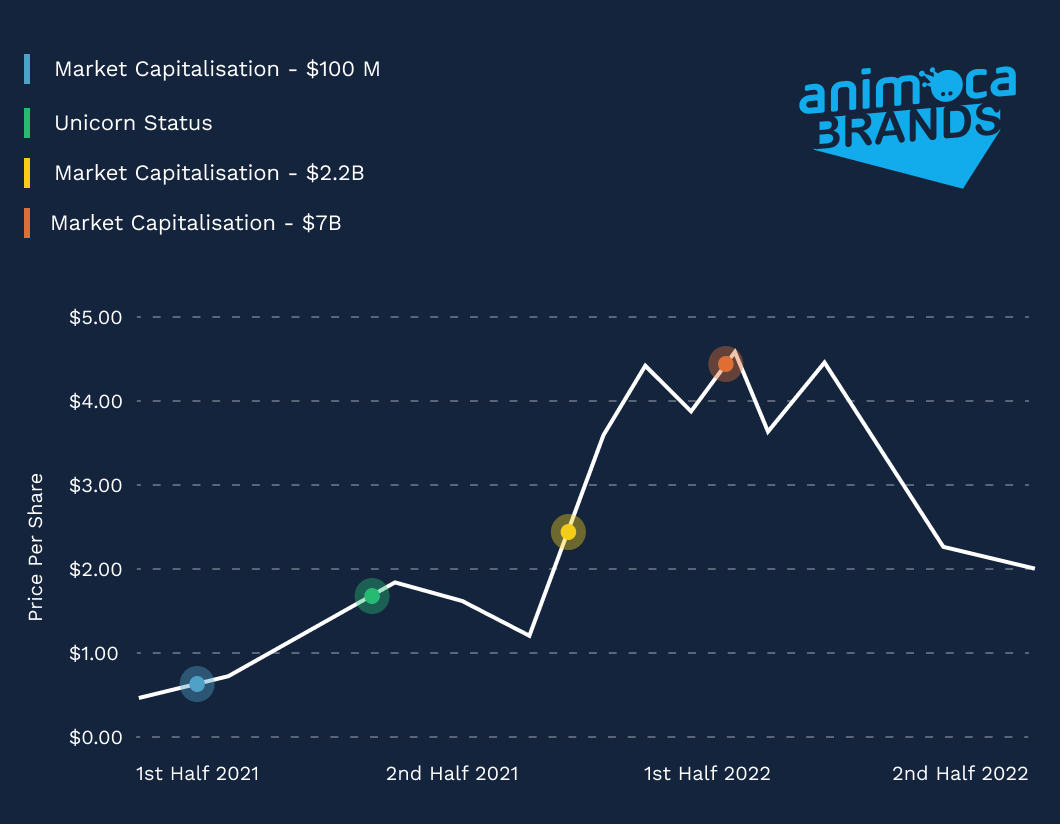

Share price growth from A$0.07 to over A$4.50 - a 2,800% increase since first listing on PrimaryMarkets

Reached A$1B market cap in May 2021 and reached A$7B in January 2022

PrimaryMarkets has successfully traded over A$180M in Animoca shares

Ability to tap its Global popularity by giving followers the ability to directly invest

From an ASX delisting to a global technology Unicorn

Read the full Animoca Brands case study

“…[We] create true ownership of these assets… If I could have ownership, I’ll pay for it and pay more value for it. Every person who plays blockchain gaming has ownership… You’re invested in it.”

Yat Siu

Founder, Animoca Brands

Who is Animoca Brands?

Animoca brands, the global leader in digital entertainment, blockchain and gamification, was founded in 2014 by Yat Siu.

The company has amassed a large portfolio of over 340 investments on its mission to advance digital property rights and build the metaverse.

Animoca Brands has built an ever-increasing galaxy of the most popular and widely played blockchain and Web 3 games.

By leveraging blockchain’s popularity, traditional games and global brand names like Disney and Power Rangers, Animoca has fast become the leader in the metaverse.