Case study

Virtual Gaming Worlds

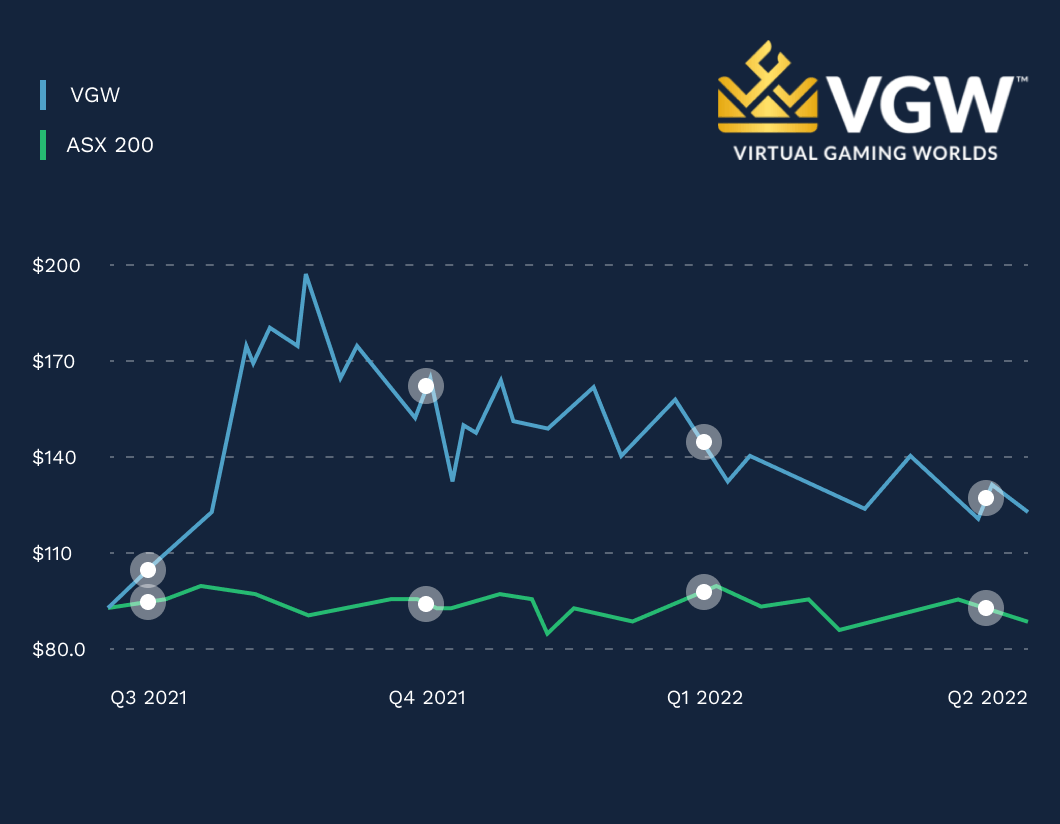

Virtual Gaming Worlds decision to remain private could have limited their ability to grow, but by approving private share trading they accessed many of the benefits of a public stock exchange listing

How VGW Ignited Shareholder Liquidity to Remain Private Longer

As Virtual Gaming Worlds grew from a start-up in 2010, shareholders had no way to sell their shares or access liquidity.

Without a public stock exchange listing VGW shareholders had no readily available means to sell their shares. Shareholders were forced to navigate the private markets on their own, causing a distraction for senior executives in charge of growing this nascent company into a global leader in online gaming.

Fast forward to 2023 and VGW has reached Unicorn status (market cap > US$1B) with the 6th highest annual revenue for any unlisted Australian company, all while remaining privately held.

Find out how VGW was able to maintain the benefits of remaining a private company while driving liquidity in its shares and growing its global investor base after listing on the PrimaryMarkets unlisted companies trading platform.

What Happened After VGW Opened their Trading Hub

Their share price grew 2,500% from A$0.16 to a high of over A$5.00 per share at their peak

Reached a market cap of A$1B in Feb 2021 and A$3B in Sept 2021

PrimaryMarkets has successfully traded over A$50M in VGW shares

Successfully tapped its Global popularity by giving followers and users the opportunity to directly invest

From an ASX delisting to a global technology Unicorn

Read the full Animoca Brands case study

“I played a regular home poker game with my best friends. When they moved to Melbourne for their careers, these games stopped but I found it crazy … We couldn’t replicate a quality game experience with real money poker wagers inside a multiplayer game environment”

Laurence Escalante

Founder, Virtual Gaming Worlds

Who is Virtual Gaming Worlds

VGW is a global leader in online social casino and poker games

Founded in 2010 by Australian entrepreneur Laurence Escalante company revenues exceeded A$3B for the first time in FY22

Operating profits over A$550M and a market capitalisation at its peak on PrimaryMarkets Platform of more than A$5B

VGW has led the technology revolution in online casino games of chance