Case study

Virtual Gaming Worlds

How VGW achieved Unicorn status and liquidity-without an ASX listing

Introduction

Founded in 2010 by Australian entrepreneur Laurence Escalante, Virtual Gaming Worlds (VGW) began as a small startup in Perth with a bold vision to become the biggest gaming company in the world with games that thrill.

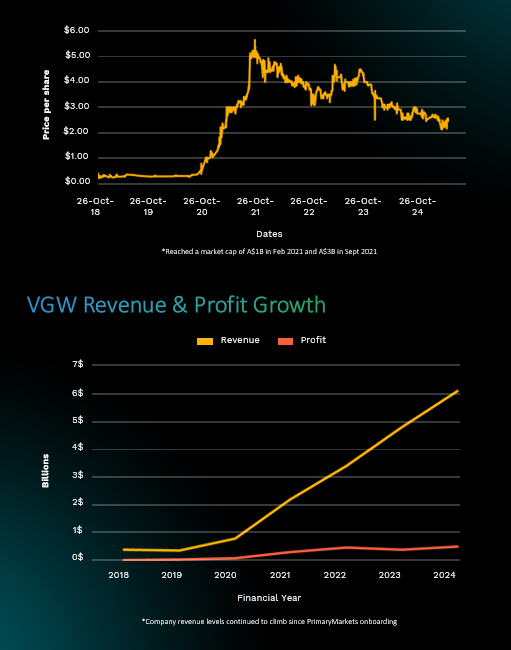

Today, VGW is one of Australia’s most successful private companies. It has consistently delivered blockbuster financial performance—recording revenue of A$6.1 billion and profit of A$492 million in FY 2024. In a strategic move to balance control with liquidity, VGW chose not to list on the ASX. Instead, it opted for private share trading via PrimaryMarkets. This allowed VGW to combine the benefits of liquidity and global reach while maintaining full control over its destiny.

VGW Background

Core products: Leading social casino platforms—Chumba Casino, Global Poker and LuckyLand Slots—targeting millions of North American players with freemium and sweepstakes-based models.

Scale: In mid-2024, VGW was ranked as Australia’s 6th largest private company by revenue according to IBIS.

Why didn't VGW List on the ASX?

VGW deliberately avoided an ASX listing. Key reasons include

Regulatory & Compliance Burden: Public listing would incur high costs, complex governance and ongoing disclosure obligations—shifting focus away from core innovation.

Strategic Nimbleness: Staying private preserved operational flexibility, enabling bold moves including acquisitions without public scrutiny.

VGW and PrimaryMarkets

To overcome the limitations of remaining private without sacrificing shareholder liquidity, VGW opened a Private Trading Hub with PrimaryMarkets in 2018.

Comprehensive Trading with Built-In Controls

PrimaryMarkets Share Trading Platform provided VGW with a complete solution for secondary trading. The Company established its own trading parameters to safeguard both shareholders and the business, while benefiting from PrimaryMarkets independent oversight, transparent processes and secure escrow services that ensured every transaction was executed with integrity.

Structured Secondary Trading

Enabled VGW shares to trade in a secure, transparent and controlled environment.

Real Major liquidity events

Over A$95 million in value traded on the PrimaryMarkets Platform.

Valuation Momentum

VGW’s share price grew from a baseline of ~A$0.16 in 2018 to over A$5.00 helping drive market cap milestones: A$1B (Feb 2021), A$3B (Sept 2021) and at privatisation over A$3.2B (Aug 2025).

Global Investor Access

Gained exposure to PrimaryMarkets extensive investor network—institutions, family offices and sophisticated investors.

VGW's Journey

Since opening its Private Trading Hub on PrimaryMarkets, VGW’s trajectory has been extraordinary.

Share Price Growth of over 2,500% ($0.16 to $5.00).

Market Cap Growing to Mulit-Billion Dollar Levels.

Over 56 Million Shares changed Hands.

Laurence Escalante, who held ~70% of shares, launched two ownership consolidation schemes while on the PrimaryMarkets Platform, consisting of:

A buy-back in May 2023 where VGW paid ~$251 million to buy back shares at $6.50 per share.

A privatization bid for the remaining 30% was launched in August 2025. Shareholders were offered $5.05 per share, valuing VGW at $3.2 B

The privatisation was approved by ~91% of shareholders and the parent entity was relocated to Guernsey to streamline reporting and tax structure.

VGW Share Price

Highlights on PrimaryMarkets

Global Reach, Private Control

VGW thrived without ASX listing by leveraging the PrimaryMarkets Platform to facilitate liquidity while and maintaining a founder-led strategy.

Financial Track Record

A$945M revenue in H1 FY21, A$2.8B in H1 2024, full-year FY24 A$6B

Unicorn Status and Beyond

Market cap of A$1B in 2021 growing to $3.2B in 2025

Liquidity Delivered

A$95M+ in trades

Strategic Consolidation

Founder buyout at $5.05/share (~A$3.2B valuation) in 2025

Valuation Growth

Share price increase >2,500%

Closing Note

VGW’s journey offers a compelling blueprint, private companies can deliver scale, liquidity and global investor access—without a public listing.

By harnessing strategic partnerships, innovative business models and savvy financial engineering, VGW struck the balance between control and capital efficiency.

The VGW story showcases how bold, adaptive leadership can produce a gaming powerhouse while navigating regulatory complexity, serving shareholders and providing liquidity all while staying private.

The Number 1 Trading Platform

For Unlisted Companies

From an ASX delisting to a global technology Unicorn

Read the full Animoca Brands case study

“I played a regular home poker game with my best friends. When they moved to Melbourne for their careers, these games stopped but I found it crazy … We couldn’t replicate a quality game experience with real money poker wagers inside a multiplayer game environment”

Laurence Escalante

Founder, Virtual Gaming Worlds

Who is Virtual Gaming Worlds

VGW is a global leader in online social casino and poker games

Founded in 2010 by Australian entrepreneur Laurence Escalante company revenues exceeded A$3B for the first time in FY22

Operating profits over A$550M and a market capitalisation at its peak on PrimaryMarkets Platform of more than A$5B

VGW has led the technology revolution in online casino games of chance